All Forms And All Books Catalog

-

2025 OBBBA: Income Tax Planning (1-Hour Audio & 40-Page Detailed Analysis)$69.00

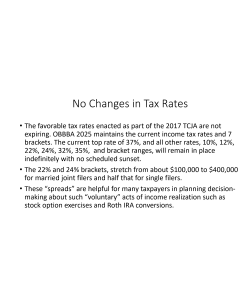

2025 OBBBA: Income Tax Planning (1-Hour Audio & 40-Page Detailed Analysis)$69.00In this 1-hour August 12, 2025 program, Steven G. Siegel explains selected income tax provisions of the 2025 OBBBA (One Big Beautiful Bill Act), also known as H.R. 1, and provides important planning suggestions for those provisions.

FREE ~ 5 MINUTES: To hear - for free - approximately five minutes of this audio presentation by Mr. Siegel, please click here: 5 Minutes FREE.

Learn More -

All (11) Steve Siegel Planning Podcasts$657.00

All (11) Steve Siegel Planning Podcasts$657.00SAVE when you purchase All (11) Steve Siegel Podcasts.

(click any podcast title for a description including five-minute audio sample or to purchase individually. Individual podcast pricing is noted next to each title):

Learn More

3 IDGT Forms Explained (1-Hour Audio) - $99

5 Medicaid Planning Trusts Explained (1.5-Hour Audio) - $59

2025 OBBBA: Income Tax Planning (1-Hour Audio & 40-Page Detailed Analysis) - $69

Critical Tax Planning: Looking Ahead to Uncertain Times (1.5-Hour Audio) - $59

Decedent’s Final Return; Postmortem Income Tax Planning (1-Hour Audio) - $59

Detailed Planning Analysis And New Planning Suggestions: The SECURE Act: A Retirement Plan Distribution Game-Changer (1-Hour Audio) - $59

Dynasty Trust Form Explained (1-Hour Audio) - $99

IRC Sec. 199A Simplified (43-Minute Audio Recording) - $99

Portability: More Important Than Ever (80-Minute Audio) - $59

Spousal Lifetime Access Trusts (SLATs): The Popular Estate Planning Tool (1-Hour Audio) - $99

Understanding The SECURE Act (1.3-Hour Audio) - $59 -

All Books AND All Forms Catalog$0.00

All Books AND All Forms Catalog$0.00This catalog lists All Books AND All Forms currently available on www.NLFforms.com. The catalog is easy to view eletronically and to print. Books and Forms are listed by practice area.

Learn More

FREE Catalog: In order to obtain this Free Catalog, please:

1. click the above "Add To Cart"

2. proceed with Checkout and then

3. if you already have an account, merely login or if you do not yet have an account, just create an account.

You do NOT need to enter any credit card information unless you are purchasing forms or books. -

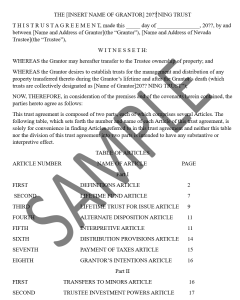

Incomplete Non-Grantor Trust (“ING Trust”)$129.00

Incomplete Non-Grantor Trust (“ING Trust”)$129.00This document is an Incomplete Non-Grantor Trust (“ING Trust”). It is drafted with a Nevada Trustee, and intended to have Nevada as its situs, but it may be used as a template for other states which do not have a state income tax (South Dakota, Alaska, Delaware (for non-residents) Wyoming, etc.) where ING Trusts are favored. In such other states, it is necessary to have a trustee situated in that state as the trustee. Attention should be paid to determine if other states have specific provisions that should be added to this document.

The purpose of an ING Trust is to hold assets of a taxpayer who resides in a high-income tax state and allow those assets to not be subjected to income tax in the state of the taxpayer’s residence, since the trust is not a grantor trust of the taxpayer. Instead, the trust is created as a non-grantor trust, subject to the income tax laws of the state where the trust is located, in this case, Nevada. Since Nevada does not have an income tax, the income is not subjected to state tax if it is not distributed. If it is distributed, then it is subject to the income tax laws of the state of the distributee’s residence.An ING is used by people in high income tax states (like CA for example) to move intangible investment assets into it to avoid the income from them being subjected to CA income tax. Thus, it is a “device” designed to eliminate state (not federal) income tax.

Last November, Massachusetts passed a new law increasing the income tax rate on incomes over $1 million by 4%. For those clients, an ING might be very appealing.

Of course, advisers need to check their state law. New York passed a law saying if you have an ING it will still be taxed by New York as a grantor trust (income taxed to the grantor). However, New York residents might still create INGs and see if New York law holds up.

Learn More -

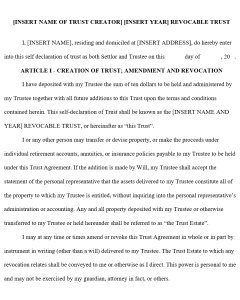

Revocable Living Trust for Childless Couple (12 Pages)$49.00

Revocable Living Trust for Childless Couple (12 Pages)$49.00This document is a self-declaration of trust by the grantor/trustee. It contains life benefit directives for the grantor, as well as the dispositive provisions of the grantor’s estate plan. It is completely revocable by the grantor while living. The intent in using this trust is to have most or all of the grantor’s property titled in the name of this trust while the grantor is alive in order to avoid probate. The Revocable Living Trust is commonly used in those states where probate is difficult, expensive, cumbersome, time-consuming, delay-inducing, etc.

The Revocable Living Trust is also useful as a management document to handle the affairs of an elderly relative even when probate issues are not a concern. Persons owning property in multiple states may consider using this Trust to avoid the costs of ancillary probate in those states, some of which might have burdensome probate rules.

Learn More -

Trusts Explained (56-Page Book)$99.00

Trusts Explained (56-Page Book)$99.00In this 56-Page book, Steven G. Siegel thoroughly explains the most frequently used trusts. Mr. Siegel includes Planning Pointers along with his detailed trust explanations. Whether you are a current planner or interested in becoming knowledgeable about this practice area, this book will be of value to you.

The trust is an essential tool of the planner and is widely used in financial and estate planning. It is simply an arrangement by which one person holds legal title to an asset and manages it for the benefit of someone else. It has, of course, many uses outside the field of financial and estate planning. One can use a trust in a business setting. For example, consider the employee benefit trust, the debtor-creditor trust, the voting trust, and the trust used in connection with sales and financing. A trust is an excellent asset protection vehicle. Given the wide array of potential uses, certain trusts have also become the subject of abuse by unscrupulous promoters and have been included in the IRS “Dirty Dozen Tax Scams.” As a result, the planner should be cognizant of this fact and ensure a legitimate and valid purpose of any trust vehicle.

Learn More