Trusts Explained (56-Page Book)

In this 56-Page book, Steven G. Siegel thoroughly explains the most frequently used trusts. Mr. Siegel includes Planning Pointers along with his detailed trust explanations. Whether you are a current planner or interested in becoming knowledgeable about this practice area, this book will be of value to you.

The trust is an essential tool of the planner and is widely used in financial and estate planning. It is simply an arrangement by which one person holds legal title to an asset and manages it for the benefit of someone else. It has, of course, many uses outside the field of financial and estate planning. One can use a trust in a business setting. For example, consider the employee benefit trust, the debtor-creditor trust, the voting trust, and the trust used in connection with sales and financing. A trust is an excellent asset protection vehicle. Given the wide array of potential uses, certain trusts have also become the subject of abuse by unscrupulous promoters and have been included in the IRS “Dirty Dozen Tax Scams.” As a result, the planner should be cognizant of this fact and ensure a legitimate and valid purpose of any trust vehicle.

In this 56-Page book, Steven G. Siegel thoroughly explains the most frequently used trusts. Mr. Siegel includes Planning Pointers along with his detailed trust explanations. Whether you are a current planner or interested in becoming knowledgeable about this practice area, this book will be of value to you.

The trust is an essential tool of the planner and is widely used in financial and estate planning. It is simply an arrangement by which one person holds legal title to an asset and manages it for the benefit of someone else. It has, of course, many uses outside the field of financial and estate planning. One can use a trust in a business setting. For example, consider the employee benefit trust, the debtor-creditor trust, the voting trust, and the trust used in connection with sales and financing. A trust is an excellent asset protection vehicle. Given the wide array of potential uses, certain trusts have also become the subject of abuse by unscrupulous promoters and have been included in the IRS “Dirty Dozen Tax Scams.” As a result, the planner should be cognizant of this fact and ensure a legitimate and valid purpose of any trust vehicle.

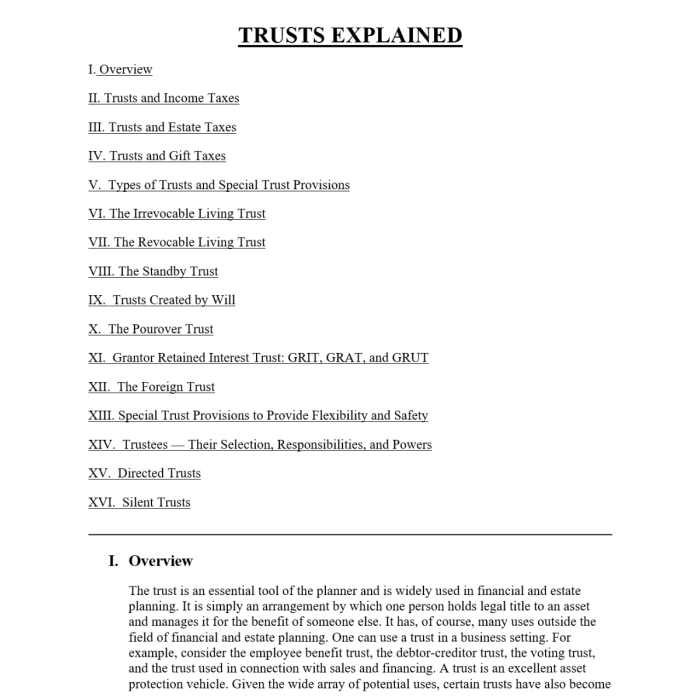

The following is covered in this 56-Page Book by Steven G. Siegel:

I. Overview

II. Trusts and Income Taxes

III. Trusts and Estate Taxes

IV. Trusts and Gift Taxes

V. Types of Trusts and Special Trust Provisions

VI. The Irrevocable Living Trust

VII. The Revocable Living Trust

VIII. The Standby Trust

IX. Trusts Created by Will

X. The Pourover Trust

XI. Grantor Retained Interest Trust: GRIT, GRAT, and GRUT

XII. The Foreign Trust

XIII. Special Trust Provisions to Provide Flexibility and Safety

XIV. Trustees - Their Selection, Responsibilities, and Powers

XV. Directed Trusts

XVI. Silent Trusts

Mr. Steven G. Siegel

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization.

-

Dynasty Trust (34 Pages)Special Price $129.00 Regular Price $149.00

Dynasty Trust (34 Pages)Special Price $129.00 Regular Price $149.00