DEAL FOR A WEEK; New Forms & Books

-

12 Will Forms (168 Pages)Special Price $299.00 Regular Price $349.00

12 Will Forms (168 Pages)Special Price $299.00 Regular Price $349.00SAVE when you purchase ALL 12 WILLS (168 Pages). Upon purchase, each form will be immediately available and stored in your master account on www.nlfforms.com for your unlimited use.

Click "Learn More" for the full list of Will Forms. Each of the Wills included are also available for individual purchase.

Learn More -

2025 OBBBA: Estate, Trust and Tax Planning (33-Minute Audio & 28-Page Detailed Analysis)$69.00

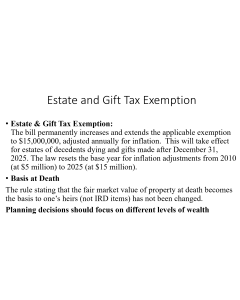

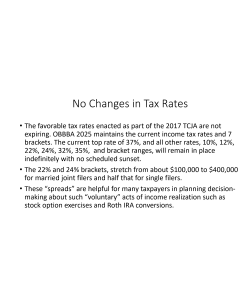

2025 OBBBA: Estate, Trust and Tax Planning (33-Minute Audio & 28-Page Detailed Analysis)$69.00In this 33-minute August 15, 2025, program, Steven G. Siegel explains selected estate, trust, and tax planning strategies post-2025 OBBBA (One Big Beautiful Bill Act), also known as H.R. 1. This program explains strategies that remain useful under OBBBA, with a focus on income tax basis adjustments and the use of non-grantor trusts to expand use of the 2025 Act tax changes (SALT, 1202, 199A, etc.).

Learn More -

2025 OBBBA: Income Tax Planning (1-Hour Audio & 40-Page Detailed Analysis)$69.00

2025 OBBBA: Income Tax Planning (1-Hour Audio & 40-Page Detailed Analysis)$69.00In this 1-hour August 12, 2025 program, Steven G. Siegel explains selected income tax provisions of the 2025 OBBBA (One Big Beautiful Bill Act), also known as H.R. 1, and provides important planning suggestions for those provisions.

FREE ~ 5 MINUTES: To hear - for free - approximately five minutes of this audio presentation by Mr. Siegel, please click here: 5 Minutes FREE.

Learn More -

3 Subchapter S Trust Forms (43 Pages)Special Price $159.00 Regular Price $177.00

3 Subchapter S Trust Forms (43 Pages)Special Price $159.00 Regular Price $177.00SAVE when you purchase 3 Subchapter S Trust Forms which includes: Electing Small Business Trust (13 Pages), Qualified Subchapter S Trust (16 Pages), and Voting Trust Agreement (14 Pages).

Learn More -

4 Charitable Trusts: CLAT, CLUT, CRAT and CRUT (4 Trusts, 158 Pages)Special Price $359.00 Regular Price $396.00

4 Charitable Trusts: CLAT, CLUT, CRAT and CRUT (4 Trusts, 158 Pages)Special Price $359.00 Regular Price $396.00Save when you purchase ALL 4 Charitable Trust Forms including: Charitable Lead Annuity Trust (CLAT) (41 Pages), Charitable Lead Unitrust (CLUT) (43 Pages), Charitable Remainder Annuity Trust (CRAT) (38 Pages), and Charitable Remainder Unitrust (CRUT) (36 Pages). Click "learn more" for a detailed description of each form.

Learn More -

5 Accumulation Trusts (5 Trusts, 86 Pages)Special Price $249.00 Regular Price $315.00

5 Accumulation Trusts (5 Trusts, 86 Pages)Special Price $249.00 Regular Price $315.00Here Are The 5 Accumulation Trusts Included:

Learn More -

Discretionary Accumulation Trust (14 Pages)Special Price $85.00 Regular Price $99.00

Discretionary Accumulation Trust (14 Pages)Special Price $85.00 Regular Price $99.00This Form of an IRA and Retirement Plan Beneficiary See-Through Trust is designed to distribute the Grantor’s Retirement Plans, qualified plans as well as IRAs, to a trust as the designated beneficiary of the Retirement Plans for the lifetime benefit of a child of the Grantor. The required minimum distributions rules must be observed, and the Trustee is authorized in its discretion to make payments to the Beneficiary as well as to the spouse and children of the Beneficiary. Provision is also made for additional issue of the Beneficiary.

Learn More -

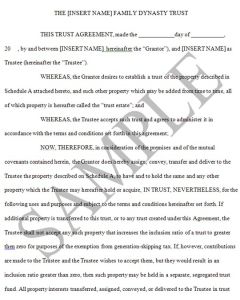

Dynasty Trust (34 Pages)Special Price $129.00 Regular Price $149.00

Dynasty Trust (34 Pages)Special Price $129.00 Regular Price $149.00This Form is a Dynasty Trust, intended to be created for the benefit of the children and more remote descendants of the Grantor, and designed to be a perpetual trust. Ideally, this trust is created in a State that has repealed the rule against perpetuities, thus allowing for the perpetual duration of the trust.

Learn More

While the Dynasty Trust Form is not state specific, it is fully-editable. You can add state specific language as needed. -

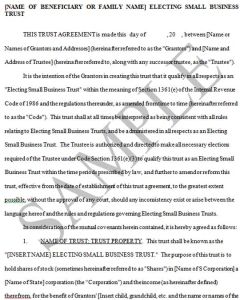

Electing Small Business Trust (13 Pages)Special Price $59.00 Regular Price $69.00This Trust is an Electing Small Business Trust, i.e. a Trust created to follow the rules and requirements that allow this Trust to be treated as a valid S corporation shareholder. The Electing Small Business Trust is often used in estate and/or income tax planning where S corporation owners wish to transfer some of the S corporation shares, but do not wish their children to gain any control over the corporation (hence no outright transfer) or be obliged to receive annual distributions of income (as would be the requirement if a Qualified Subchapter S Trust were created). The “ESBT” allows more control of the stock and its income by the Trustee. The Trust may also hold property other than the shares of an S corporation.Learn More

Electing Small Business Trust (13 Pages)Special Price $59.00 Regular Price $69.00This Trust is an Electing Small Business Trust, i.e. a Trust created to follow the rules and requirements that allow this Trust to be treated as a valid S corporation shareholder. The Electing Small Business Trust is often used in estate and/or income tax planning where S corporation owners wish to transfer some of the S corporation shares, but do not wish their children to gain any control over the corporation (hence no outright transfer) or be obliged to receive annual distributions of income (as would be the requirement if a Qualified Subchapter S Trust were created). The “ESBT” allows more control of the stock and its income by the Trustee. The Trust may also hold property other than the shares of an S corporation.Learn More -

Essential Estate Planning Forms (59 Forms, 648 Pages)$1,499.00

Essential Estate Planning Forms (59 Forms, 648 Pages)$1,499.00Scroll down to read the list of included forms.

SAVE and establish or expand your library with Essential Estate Planning Forms (59 Forms, 648 Pages).

Reference these forms to save drafting time and compare how Steve Siegel drafts his documents. See the detailed description for the list of included forms. Each form is fully editable and yours for immediate and unlimited use upon purchase.

Learn More