Will/Trust Clauses

-

15 Dispositive Will Clauses (19 Pages)$129.00

15 Dispositive Will Clauses (19 Pages)$129.00PLEASE NOTE: The price of the of ALL (15) Dispositive Will Clauses To Address 6 Key Drafting Issues is just $129. Alternatively, the Will Clause(s) for each drafting issue may be purchased individually for $19 per issue.

To do so, please click "Will/Trust Clauses" category on the homepage and scroll down to the below-titled issue(s) you want.

Learn More -

21 Administrative Will Clauses (26 Pages)$129.00

21 Administrative Will Clauses (26 Pages)$129.00PLEASE NOTE: The price of the of ALL (21) Administrative Will Clauses To Address 9 Key Drafting Issues is just $129. Alternatively, Will Clause(s) to address each drafting issue may be purchased individually for $19 per form.

Learn More

In order to purchase Will Clauses individually, please click "Will Clauses" category on the homepage and scroll down the page. -

4 Disclaimer Forms (22 Pages)$81.00

4 Disclaimer Forms (22 Pages)$81.00Click "Learn More" above for more information about our 4 Disclaimer forms. Alternatively, each Disclaimer form may be purchased individually.

Learn More -

5-PAGE WRITTEN GENERAL EXPLANATION: The SECURE Act: A Retirement Plan Distribution Game-Changer$0.00

5-PAGE WRITTEN GENERAL EXPLANATION: The SECURE Act: A Retirement Plan Distribution Game-Changer$0.00FREE FORMS: In order to obtain this Free Form, please:

1. click the above "Add To Cart"

2. proceed with Checkout and then

3. if you already have an account, merely login or if you do not yet have an account, just create an account.

You do NOT need to enter any credit card information unless you are purchasing other forms.The SECURE Act (Setting Every Community Up for Retirement Enhancement) was signed into law on December 20, 2019, and is effective for deaths occurring in 2020 and beyond. To assist you in understanding the SECURE Act, Mr. Siegel has written this useful 5-page explanation.Learn More -

Address the Possibility of Exposure to the Generation-Skipping Transfer Tax and Give the Fiduciary the Opportunity to Avoid the Tax by Creating a General Power of Appointment - 1 Clause (3 Pages)$19.00

Address the Possibility of Exposure to the Generation-Skipping Transfer Tax and Give the Fiduciary the Opportunity to Avoid the Tax by Creating a General Power of Appointment - 1 Clause (3 Pages)$19.00With all of the uncertainty in the federal tax laws about the amount of the exclusion from the federal estate tax, the amount of the exclusion from the generation-skipping transfer tax, and the future tax rates to be imposed – as well as the uncertainties inherent in life as to who may survive the testator and what may be the value of the testator’s estate at the time of death – it is helpful to include some “what if” provisions in the Will to address these uncertainties.

Learn More

CLAUSE 1: Allow for Discretionary Allocations of the GST Exemption; Allow for the Creation of a General Power of Appointment for Skip Persons -

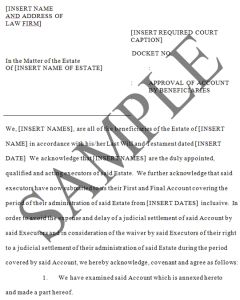

Approval Of Accounting By Estate Beneficiaries (4 Pages)$19.00

Approval Of Accounting By Estate Beneficiaries (4 Pages)$19.00This is a Form of Approval of Account by Beneficiaries to be used in connection with the administration of an estate

Learn More -

Asset Protection from the Claims of Creditors Clauses - 2 Clauses$29.00

Asset Protection from the Claims of Creditors Clauses - 2 Clauses$29.00There are essentially two types of asset protection available in a Will, namely spendthrift protection and discretionary trust protection. A spendthrift clause protects against the creditors of a beneficiary attaching the assets at the estate or trust level and forcing a distribution in satisfaction of the creditor’s claim. Discretionary trust protection is based on the fact that a beneficiary lacks an enforceable right to a distribution and has nothing more than an expectancy that cannot be attached by creditors.

Learn More

2 Clauses To Address The Following Issues:

CLAUSE 1: Spendthrift Clause

CLAUSE 2: Discretionary Trust Distribution Language -

Clauses To Protect the Estate Plan with Appropriate Simultaneous Death Clauses - 4 Clauses (3 Pages)$19.00

Clauses To Protect the Estate Plan with Appropriate Simultaneous Death Clauses - 4 Clauses (3 Pages)$19.00While the simultaneous deaths of family members are admittedly a rare occurrence, they do sometimes happen. Such tragedies as auto and airplane crashes, home fires and explosions, etc. make it important to address the possibility of simultaneous death in every well-drafted Will. The laws of most states follow the Uniform Simultaneous Death Act which presumes that a person must survive another by 120 hours to be deemed to be the survivor. However, all of the states allow a Will to vary and/or override the presumption contained in the law, and set forth the testator’s own plan.

4 Clauses To Address The Following Issues:

CLAUSE 1: Simple Statement of Survival for Spouses: One with Least Property Survives

CLAUSE 2: Spouse with Fewer Assets is Deemed the Survivor; Others Must Survive 30 Days

CLAUSE 3: Spouse with Greater Assets is Deemed to Predecease Spouse with Fewer Assets; Others Must Survive 30 Days

CLAUSE 4: Spouses Assets Are Roughly Equivalent; Neither is the Deemed Survivor; All Beneficiaries Must Survive 30 Days

Learn More -

Concerns About Beneficiaries Behavior Will Clause (2 Pages)$29.00

Concerns About Beneficiaries Behavior Will Clause (2 Pages)$29.00ISSUE: Concerns About Behavior of Beneficiaries.

Learn More

When a testator creates a trust for young beneficiaries, or a potentially long-term trust for such beneficiaries, the testator may express concern that if the beneficiaries exhibit what the testator would consider inappropriate behavior, payments for that beneficiary should be suspended.

1 Clause To Address The Following Issue:

CLAUSE 1: Suspension and Resumption of Payments to a Beneficiary Exhibiting Bad Behavior. -

Credit Shelter Trust Provisions Will Clauses - 5 Clauses (aka By-Pass Trust; aka Unified Credit Trust, aka Exemption Equivalent Trust) (10 Pages)$39.00

Credit Shelter Trust Provisions Will Clauses - 5 Clauses (aka By-Pass Trust; aka Unified Credit Trust, aka Exemption Equivalent Trust) (10 Pages)$39.00Although the amount of the exemption from the federal estate tax has varied over the years, planning to take advantage of the full available exemption has always been an essential element of every well-drafted Will. Unlike the marital deduction, however, where there are strict requirements to follow to gain the benefit of the deduction, achieving the use of the exemption equivalent is not difficult – it is a given that it is available in every estate.

5 Clauses Are Included To Address The Following Issues:

CLAUSE 1: Create the Credit Shelter Trust for the Exclusive Benefit of the Surviving Spouse While Alive, with Remainder to Children

CLAUSE 2: Create the Credit Shelter Trust for the Benefit of the Family Group Including the Surviving Spouse and the Children of the Testator – Distributions in the Discretion of the Trustee.

CLAUSE 3: Create the Credit Shelter Share for the Benefit of the Children – Outright if Age 35; Otherwise in Trust until the Children Reach Designated Ages – 3 Increments of Principal Payments.

CLAUSE 4: Create the Credit Shelter Share for the Benefit of the Children – Outright Distributions to Children

CLAUSE 5: Allow the executor to exercise discretion to determine the optimal funding of the marital and credit shelter portions of the estate. The so-called “Clayton Clause”.

Learn More