Steve Siegel Podcasts

-

2025 OBBBA: Estate, Trust and Tax Planning (33-Minute Audio & 28-Page Detailed Analysis)$69.00

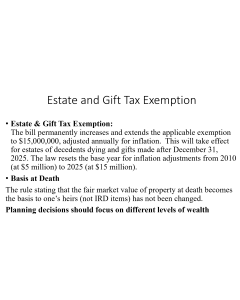

2025 OBBBA: Estate, Trust and Tax Planning (33-Minute Audio & 28-Page Detailed Analysis)$69.00In this 33-minute August 15, 2025, program, Steven G. Siegel explains selected estate, trust, and tax planning strategies post-2025 OBBBA (One Big Beautiful Bill Act), also known as H.R. 1. This program explains strategies that remain useful under OBBBA, with a focus on income tax basis adjustments and the use of non-grantor trusts to expand use of the 2025 Act tax changes (SALT, 1202, 199A, etc.).

Learn More -

2025 OBBBA: Income Tax Planning (1-Hour Audio & 40-Page Detailed Analysis)$69.00

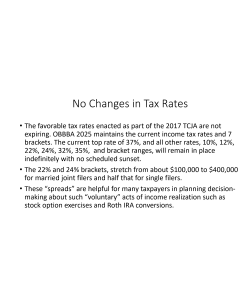

2025 OBBBA: Income Tax Planning (1-Hour Audio & 40-Page Detailed Analysis)$69.00In this 1-hour August 12, 2025 program, Steven G. Siegel explains selected income tax provisions of the 2025 OBBBA (One Big Beautiful Bill Act), also known as H.R. 1, and provides important planning suggestions for those provisions.

FREE ~ 5 MINUTES: To hear - for free - approximately five minutes of this audio presentation by Mr. Siegel, please click here: 5 Minutes FREE.

Learn More -

3 IDGT Forms Explained (1-Hour Audio)$99.00

3 IDGT Forms Explained (1-Hour Audio)$99.00In this audio recording, Mr. Siegel goes through, and explains reasons for the drafting of, all of the provisions of the three (3) forms he wrote.

Specifically, he covers Intentionally Defective Grantor Trust Forms: Intentionally Defective Grantor Trust (7 Pages), Installment Sale To Trust (3 Pages), Promissory Note For Sale To Defective Grantor Trust (2 Pages) which are on www.NLFforms.com under the "Trusts" category on the homepage. Alternatively, click here: Intentionally Defective Grantor Trust Forms for Sample Pages, Full Form(s) Description and to purchase.Learn More

FREE 5 MINUTES: To hear - for free - five minutes of this valuable and practical audio presentation by Mr. Siegel, please click here: 5 Minutes FREE -

5 Medicaid Planning Trusts Explained (1.5-Hour Audio)$59.00

5 Medicaid Planning Trusts Explained (1.5-Hour Audio)$59.00In this audio recording, Mr. Siegel goes through, and explains the reasons for the drafting of, all of the provisions of the five (5) forms he wrote.

Learn More

Specifically, he covers his: First Party Special Needs Trust (aka Self-Settled Special Needs Trust), Supplemental (aka Special) Needs Trust By Third Party, 5-Year Income Only Trust, Miller Trust, and Life Care Agreement which are on www.NLFforms.com under the "Trusts" category on the homepage. Alternatively, click here: 5 Medicaid Planning Trusts for Sample Pages, Full Form(s) Description and to purchase.

FREE 5 MINUTES: To hear - for free - five minutes of this valuable and practical audio presentation by Mr. Siegel, please click here: 5 Minutes FREE -

All (11) Steve Siegel Planning Podcasts$657.00

All (11) Steve Siegel Planning Podcasts$657.00SAVE when you purchase All (11) Steve Siegel Podcasts.

(click any podcast title for a description including five-minute audio sample or to purchase individually. Individual podcast pricing is noted next to each title):

Learn More

3 IDGT Forms Explained (1-Hour Audio) - $99

5 Medicaid Planning Trusts Explained (1.5-Hour Audio) - $59

2025 OBBBA: Income Tax Planning (1-Hour Audio & 40-Page Detailed Analysis) - $69

Critical Tax Planning: Looking Ahead to Uncertain Times (1.5-Hour Audio) - $59

Decedent’s Final Return; Postmortem Income Tax Planning (1-Hour Audio) - $59

Detailed Planning Analysis And New Planning Suggestions: The SECURE Act: A Retirement Plan Distribution Game-Changer (1-Hour Audio) - $59

Dynasty Trust Form Explained (1-Hour Audio) - $99

IRC Sec. 199A Simplified (43-Minute Audio Recording) - $99

Portability: More Important Than Ever (80-Minute Audio) - $59

Spousal Lifetime Access Trusts (SLATs): The Popular Estate Planning Tool (1-Hour Audio) - $99

Understanding The SECURE Act (1.3-Hour Audio) - $59 -

Decedent’s Final Return; Postmortem Income Tax Planning (1-Hour Audio)$59.00

Decedent’s Final Return; Postmortem Income Tax Planning (1-Hour Audio)$59.00In this one-hour July 22, 2024 program, Steven G. Siegel provides a practical explanation of how to handle a decedent’s final federal income tax return, the federal income tax returns of the estate and the numerous postmortem elections which are available.

Learn More -

Detailed Planning Analysis And New Planning Suggestions: The SECURE Act: A Retirement Plan Distribution Game-Changer (1-Hour Audio)$59.00

Detailed Planning Analysis And New Planning Suggestions: The SECURE Act: A Retirement Plan Distribution Game-Changer (1-Hour Audio)$59.00To assist you in advising your clients about retirement plan distributions under the SECURE Act, Mr. Siegel provides a detailed analysis of when planning is needed, what prior planning no longer works and new planning strategies you should consider.

Learn More -

Dynasty Trust Form Explained (1-Hour Audio)$99.00

Dynasty Trust Form Explained (1-Hour Audio)$99.00In this audio recording Mr. Siegel goes through, and explains reasons for the drafting of, all of the provisions within the Dynasty Trust Form.

He covers in detail his Dynasty Trust which is under the "Trusts" category. Alternatively, click here: Dynasty Trust (34 Pages) for Sample Pages, Full Description and to purchase.Learn More

FREE 5 MINUTES: To hear - for free - five minutes of this valuable and practical audio presentation by Mr. Siegel, please click here: 5 MINUTES FREE -

Estate Planning: Addressing And Fixing Mistakes (1.5-Hour Audio)$59.00

Estate Planning: Addressing And Fixing Mistakes (1.5-Hour Audio)$59.00In this May 20, 2024 1.5 hour (90 minute) program, Steven G. Siegel, JD, LLM gives a practical explanation of the numerous mistakes which occur in clients' estate planning. Importantly, he also provides useful suggestions of how to fix them.

Learn More

IMPORTANT: This 1-Hour Audio is available for CLE credit on our sister sites. To take this course for online study go to www.NLFonline.com. To take this course on Audio CD, Flash Drive or by Email Delivery go to www.NLFcle.com. Only purchase the audio from this website, www.NLFforms.com, if you do not want CLE credit for this program. -

IRC Sec. 199A Simplified (43-Minute Audio)$99.00

IRC Sec. 199A Simplified (43-Minute Audio)$99.00WHY YOU SHOULD LISTEN:

New IRC Section 199A - the 20% Qualified Business Income Deduction - is one of the most important, and complicated, provisions of the 2017 Tax Cuts and Jobs Act. However, in this useful talk, Steve Siegel simplifies 199A by explaining that, for most of your clients you will be able to determine if 199A is available for them by following just three steps. He then thoroughly describes those steps and how to apply them. His presentation lasts approximately 43 minutes.TOPICS:1. The Purpose Of 199A2. It Is Simplified For Most Clients Through 3 Steps3. Is There A Trade Or Business?defined; guidelines; aggregation rules; independent contractors;rental properties; Rev. Proc. 2019-7 safe harbor4. What Is The QBI?sub S corporations; partnerships; REIT income5. What Is The Client's Taxable Income Without The QBI?6. Determining The QBI Amount7. Planning And ExamplesFREE ~ 5 MINUTES: To hear - for free - approximately five minutes of this audio presentation by Mr. Siegel, please click here: 5 Minutes FREE.Learn More

UPON PURCHASE, The complete recording is immediately available in your online account for your unlimited reference. You may access your purchased recording whenever, and as often as, you wish.

**NO CLE/MCLE CREDIT: This program does not qualify for CLE or MCLE credits and no applications will be made to any state for such accreditations. If you are looking for CLE/MCLE courses, please go to www.NLFcle.com (email delivery, flash drive and audio cd courses) and www.NLFonline.com (online courses).