Intentionally Defective Grantor Trust Forms: Intentionally Defective Grantor Trust (7 Pages), Installment Sale To Trust (3 Pages), Promissory Note For Sale To Defective Grantor Trust (2 Pages)

The IDGT gives the taxpayer the opportunity to create a trust for loved ones and freeze the value of appreciating assets (business, real estate, etc.) by a non-taxable sale to the IDGT, “squeeze” that value with appropriate valuation discounts, and burn off personal assets as the trust grantor responsible to pay all the income tax on income being received by family members. Another key feature of the IDGT is the opportunity to control the basis of the trust property. By using the power of substitution, the trust grantor can replace the initial property basis with higher basis property, then hold the reacquired low basis asset until death, allowing a stepped-up basis to heirs – never having had to pay income tax on substantial appreciation.

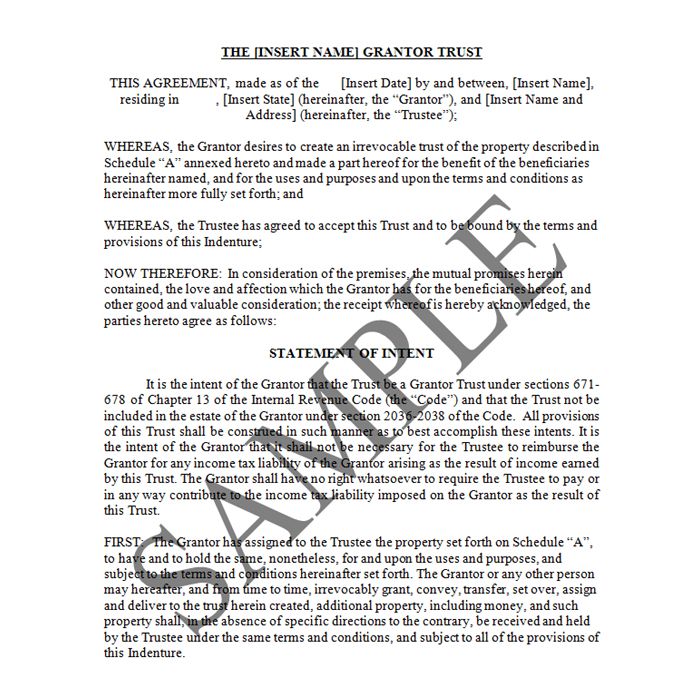

Intentionally Defective Grantor Trust

This a form of an Intentionally Defective Grantor Trust. The grantor retains an administrative power over the Trust (here, the power of substitution) (See Article 11) that leaves the grantor taxable on the trust income. This administrative power is not; however, a sufficient retained interest to require the trust property to be included in the grantor’s estate. The intent here is to enable the grantor to pay all of the income tax liability arising from the trust while allowing the actual trust income to be accumulated for or paid to the trust beneficiaries without income or gift tax consequences to them. (See Rev. Rul. 2004-64).

Installment Sale To Trust

This is a Form of installment sale agreement between the grantor of an intentionally defective grantor trust (Form A) as the seller, and the defective trust as the purchaser. The concept of this transaction is to enable the grantor to sell an appreciating asset to the trust in exchange for a Promissory Note (Form C), which sale will have the effect of freezing the value of the property being sold at its current fair market value, represented by the principal amount of the Note.

Promissory Note For Sale To Defective Grantor Trust

This is a form of Promissory Note that may be used in conjunction with an installment sale (Form B) to an intentionally defective grantor trust (Form A). The interest rate selected should be the appropriate rate based on the duration of the Note published by the IRS for the month of the sale.

The IDGT gives the taxpayer the opportunity to create a trust for loved ones and freeze the value of appreciating assets (business, real estate, etc.) by a non-taxable sale to the IDGT, “squeeze” that value with appropriate valuation discounts, and burn off personal assets as the trust grantor responsible to pay all the income tax on income being received by family members. Another key feature of the IDGT is the opportunity to control the basis of the trust property. By using the power of substitution, the trust grantor can replace the initial property basis with higher basis property, then hold the reacquired low basis asset until death, allowing a stepped-up basis to heirs – never having had to pay income tax on substantial appreciation.

Intentionally Defective Grantor Trust

This a form of an Intentionally Defective Grantor Trust. The grantor retains an administrative power over the Trust (here, the power of substitution) (See Article 11) that leaves the grantor taxable on the trust income. This administrative power is not; however, a sufficient retained interest to require the trust property to be included in the grantor’s estate. The intent here is to enable the grantor to pay all of the income tax liability arising from the trust while allowing the actual trust income to be accumulated for or paid to the trust beneficiaries without income or gift tax consequences to them. (See Rev. Rul. 2004-64).

In the “typical” Intentionally Defective Grantor Trust transaction, the grantor makes a “seed money” gift to the trust, then sells additional property to the trust (See Form B) at fair market value (possibly discounted) in exchange for an interest-bearing installment note (See Form C). The sale is not a taxable event to the grantor (See Rev. Rul. 85-13). This allows the value of the grantor’s asset sold to the Trust to be “frozen” at its value on the date of the sale through the use of the note, and further allows the grantor’s other retained assets to be “burned off” by the grantor’s required income tax payments on the trust’s income.

Installment Sale To Trust

This is a Form of installment sale agreement between the grantor of an intentionally defective grantor trust (Form A) as the seller, and the defective trust as the purchaser. The concept of this transaction is to enable the grantor to sell an appreciating asset to the trust in exchange for a Promissory Note (Form C), which sale will have the effect of freezing the value of the property being sold at its current fair market value, represented by the principal amount of the Note. Future appreciation will inure to the benefit of the trust beneficiaries, not to the grantor. Since the grantor is taxable on all of the income of the trust that is the purchaser here, the grantor is treated as selling an asset to him or herself, so this sale is not a taxable event for income tax purposes. Rev. Rul. 85-13.

Promissory Note For Sale To Defective Grantor Trust

This is a form of Promissory Note that may be used in conjunction with an installment sale (Form B) to an intentionally defective grantor trust (Form A). The interest rate selected should be the appropriate rate based on the duration of the Note published by the IRS for the month of the sale. In the typical transaction, the Note is set up for payments of interest only for the duration of the term of the Note (as here), with a balloon payment of principal due at the end of the Note. If desired, however, the principal balance can be amortized over the term of the Note.

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization.

Contact the Siegel Group through its president, Steven G. Siegel, e-mail: [email protected]