Incomplete Non-Grantor Trust (“ING Trust”)

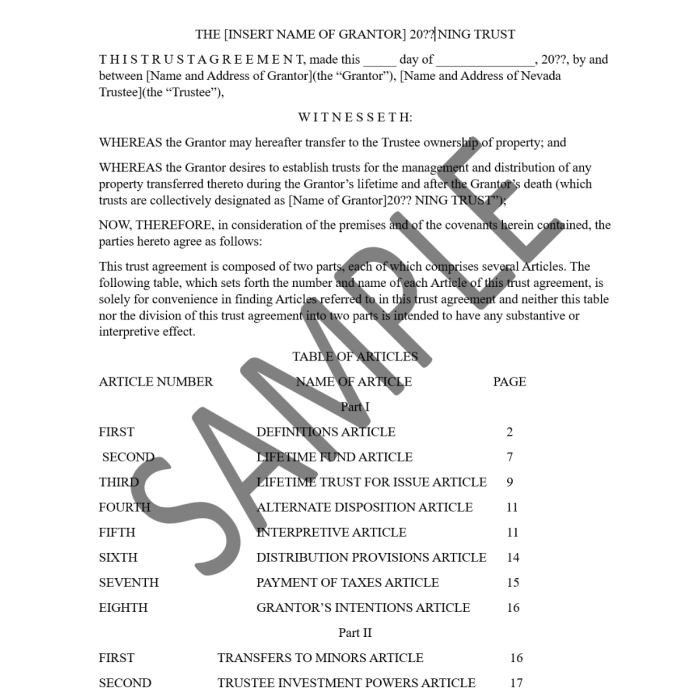

This document is an Incomplete Non-Grantor Trust (“ING Trust”). It is drafted with a Nevada Trustee, and intended to have Nevada as its situs, but it may be used as a template for other states which do not have a state income tax (South Dakota, Alaska, Delaware (for non-residents) Wyoming, etc.) where ING Trusts are favored. In such other states, it is necessary to have a trustee situated in that state as the trustee. Attention should be paid to determine if other states have specific provisions that should be added to this document.

The purpose of an ING Trust is to hold assets of a taxpayer who resides in a high-income tax state and allow those assets to not be subjected to income tax in the state of the taxpayer’s residence, since the trust is not a grantor trust of the taxpayer. Instead, the trust is created as a non-grantor trust, subject to the income tax laws of the state where the trust is located, in this case, Nevada. Since Nevada does not have an income tax, the income is not subjected to state tax if it is not distributed. If it is distributed, then it is subject to the income tax laws of the state of the distributee’s residence.

An ING is used by people in high income tax states (like CA for example) to move intangible investment assets into it to avoid the income from them being subjected to CA income tax. Thus, it is a “device” designed to eliminate state (not federal) income tax.

Last November, Massachusetts passed a new law increasing the income tax rate on incomes over $1 million by 4%. For those clients, an ING might be very appealing.

Of course, advisers need to check their state law. New York passed a law saying if you have an ING it will still be taxed by New York as a grantor trust (income taxed to the grantor). However, New York residents might still create INGs and see if New York law holds up.

This document is an Incomplete Non-Grantor Trust (“ING Trust”). It is drafted with a Nevada Trustee, and intended to have Nevada as its situs, but it may be used as a template for other states which do not have a state income tax (South Dakota, Alaska, Delaware (for non-residents) Wyoming, etc.) where ING Trusts are favored. In such other states, it is necessary to have a trustee situated in that state as the trustee. Attention should be paid to determine if other states have specific provisions that should be added to this document.

The purpose of an ING Trust is to hold assets of a taxpayer who resides in a high-income tax state and allow those assets to not be subjected to income tax in the state of the taxpayer’s residence, since the trust is not a grantor trust of the taxpayer. Instead, the trust is created as a non-grantor trust, subject to the income tax laws of the state where the trust is located, in this case, Nevada. Since Nevada does not have an income tax, the income is not subjected to state tax if it is not distributed. If it is distributed, then it is subject to the income tax laws of the state of the distributee’s residence.

The trust is not a grantor trust with respect to the grantor because of the presence in the trust of the Power of Appointment Committee. The members of this Committee include the trust beneficiaries who have the power to distribute trust income and property to the grantor, the grantor’s spouse, and other descendants of the grantor’s parents (i.e. themselves). Since the Committee members are adverse to the grantor, under the grantor trust laws, the power to make distributions to the grantor does NOT make the trust a grantor trust. The document makes certain that no other grantor powers are reserved to the grantor.

The transfers by the grantor of assets to fund the trust do NOT constitute taxable gifts by the grantor to the trust. This is because the grantor retains a limited power of appointment to appoint the trust property to the beneficiaries named in the document. This retained limited power makes the gift of the grantor’s property to the trust an incomplete gift for gift tax purposes.

Accordingly, the trust is call “Incomplete” since the limited power of appointment avoids a completed gift issue, and “Non-Grantor” since the Power of Appointment Committee (the “adverse party”) avoids the grantor trust issue. With the trust properly designed, state income tax otherwise imposed on the grantor’s assets is avoided.

An ING is used by people in high income tax states (like CA for example) to move intangible investment assets into it to avoid the income from them being subjected to CA income tax. Thus, it is a “device” designed to eliminate state (not federal) income tax.

Last November, Massachusetts passed a new law increasing the income tax rate on incomes over $1 million by 4%. For those clients, an ING might be very appealing.

Of course, advisers need to check their state law. New York passed a law saying if you have an ING it will still be taxed by New York as a grantor trust (income taxed to the grantor). However, New York residents might still create INGs and see if New York law holds up.

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization.

-

Spousal Lifetime Access Trust (SLAT) (30 Pages)Special Price $129.00 Regular Price $159.00

Spousal Lifetime Access Trust (SLAT) (30 Pages)Special Price $129.00 Regular Price $159.00 -

Dynasty Trust (34 Pages)Special Price $129.00 Regular Price $149.00

Dynasty Trust (34 Pages)Special Price $129.00 Regular Price $149.00