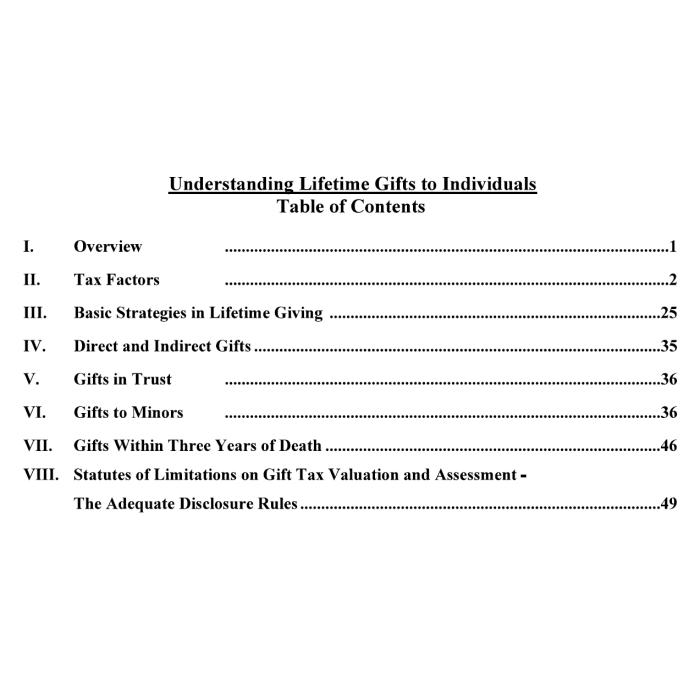

Understanding Lifetime Gifts to Individuals (50-Page Book)

Gifting is an essential element of behavior of all of our clients. Whether motivated by generosity to family or charity - or by tax savings - or both, the technical rules created by the tax laws must be understood. Despite our clients’ best impulses, gifting without understanding the rules may result in unwanted “traps for the unwary donor”. This material is designed to raise awareness of the rules and tools to make gifting “work” for everyone.

Gifting is an essential element of behavior of all of our clients. Whether motivated by generosity to family or charity - or by tax savings - or both, the technical rules created by the tax laws must be understood. Despite our clients’ best impulses, gifting without understanding the rules may result in unwanted “traps for the unwary donor”. This material is designed to raise awareness of the rules and tools to make gifting “work” for everyone.

The planner should consider whether a program of lifetime gifts to individuals is advisable for the client. Planned gifts can provide income tax and estate tax savings.

However, no one should give away money or other property that might be needed in case of a disaster or for normal living expenses. The ability to afford the gift should be the number one consideration. Especially in times of low interest rates, prospective donors and their financial advisers should make certain that the comfort of the donor is taken into account before any substantial gifting is considered.

The planner should consider the donor’s needs and desires. What satisfaction does the donor seek from the gift? Is the objective to escape from the management of the property? Does the donor hope to see the property used and enjoyed as the donor thinks it should be? These factors have very little, if anything, to do with tax savings. Nevertheless, they are important, perhaps even more important than tax factors.

Gifts do not have to be made outright. Gifts in trust can allow the donor to transfer property without giving the donee full management and control of the transferred property. The donor can achieve tax savings and provide asset protection with a transfer in trust.

Lifetime gifts are also a way of avoiding probate and eliminating the costs of bequests. They can remove future appreciation from the donor’s future estate. Therefore, gifts help to conserve the estate over and above possible tax savings.

Gifts can flow from mixed motives. When the donor is motivated primarily by benevolence, tax considerations and estate planning considerations are likely to assume importance. When a client comes to appreciate the tax benefits that can be realized by planned giving, the client understands that tax-saving considerations and strategies permit greater beneficence than would otherwise be possible. How and under what circumstances these tax savings are possible is the subject matter of this book.

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. The Siegel Group does not sell any products. It is an entirely fee-based organization.