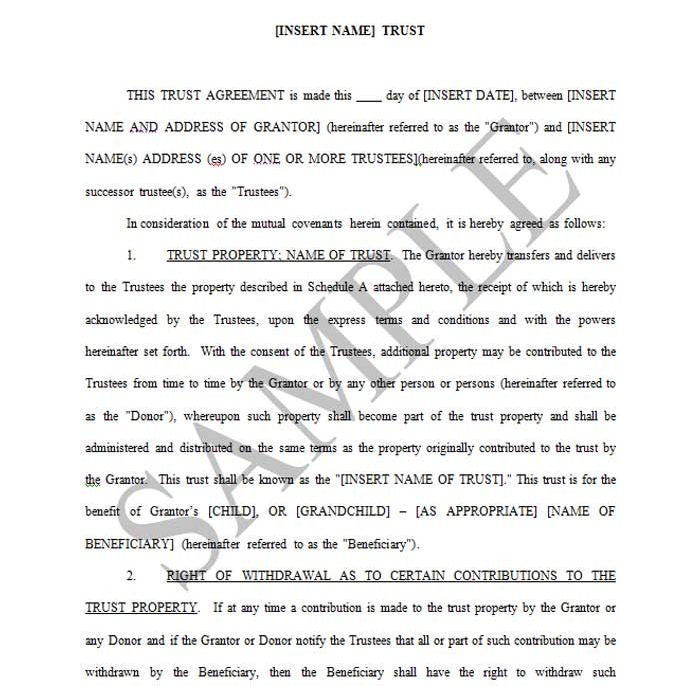

This is an irrevocable trust created by a grantor for the benefit of a minor beneficiary. It is suitable to be used for the benefit of a child or a grandchild. Notably, this trust contains a Crummey right of withdrawal which is designed to give the beneficiary a present interest in the trust which, in turn, allows the grantor to claim the present interest gift tax exclusion for gifts made to the trust. Unlike a Code Section 2503(c) trust, this Trust does not require that the trust property be distributed to the beneficiary at age 21. The presence of the Crummey power makes a required distribution at age 21 unnecessary.

As drafted, this Trust is a suitable vehicle to allow the present interest exclusion for the generation-skipping transfer tax (GST), assuming the beneficiary is limited to one grandchild. If multiple grandchildren were involved, absent separate trust shares for each, the present interest exclusion from the GST would not be available. Code Section 2642(c).

This Trust gives the trustee discretion to distribute income and principal to the beneficiary at any time for health, education, maintenance and support. When the beneficiary reaches age 21, any accumulated income is paid to the beneficiary, and regular annual income payments commence. Principal is paid to the beneficiary one-third at age 25, one-half of the balance at age 28 and the remaining balance at age 30. If desired, other ages can be substituted for the ages in the Trust.

The beneficiary is given a general power of appointment over the Trust property. In default of the exercise of such power, the property passes to the beneficiary’s descendants and, if none, to the beneficiary’s siblings.

Note the language in paragraph 5 prohibiting the Trust funds from being used by the trustee to satisfy the grantor’s obligation of support (if any) of the beneficiary.

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization.