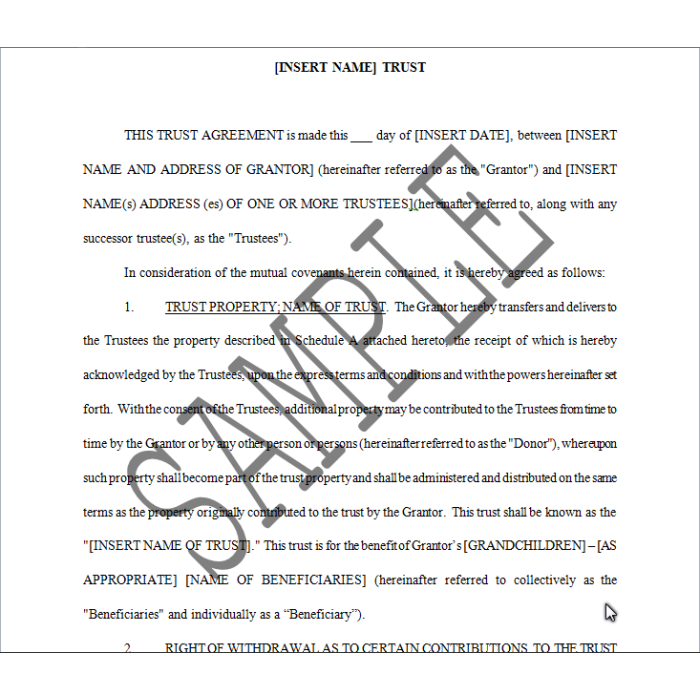

Irrevocable Trust For Multiple Children Or Grandchildren With Crummey Powers (16 Pages)

This is an irrevocable trust created by a grantor for the benefit of multiple minor beneficiaries. It is suitable to be used for the benefit of children or grandchildren. This version speaks to grandchildren, but children can be readily substituted without other modifications. Notably, this trust contains a Crummey right of withdrawal which is designed to give the beneficiaries a present interest in the trust which, in turn, allows the grantor to claim the present interest gift tax exclusion for gifts made to the trust. Unlike a Code Section 2503(c) trust, this Trust does not require that the trust property be distributed to the beneficiaries at age 21. The presence of the Crummey power makes a required distribution at age 21 unnecessary.

This is an irrevocable trust created by a grantor for the benefit of multiple minor beneficiaries. It is suitable to be used for the benefit of children or grandchildren. This version speaks to grandchildren, but children can be readily substituted without other modifications. Notably, this trust contains a Crummey right of withdrawal which is designed to give the beneficiaries a present interest in the trust which, in turn, allows the grantor to claim the present interest gift tax exclusion for gifts made to the trust. Unlike a Code Section 2503(c) trust, this Trust does not require that the trust property be distributed to the beneficiaries at age 21. The presence of the Crummey power makes a required distribution at age 21 unnecessary.

As drafted, this Trust is a suitable vehicle to allow the present interest exclusion for the generation-skipping transfer tax (GST), assuming the beneficiary is limited to one grandchild. If multiple grandchildren were involved, absent separate trust shares for each, the present interest exclusion from the GST would not be available. Code Section 2642(c). This trust creates a separate share for each beneficiary.

This Trust gives the trustee discretion to distribute income and principal to the beneficiary at any time for health, education, maintenance and support. When the beneficiary reaches age 21, any accumulated income is paid to the beneficiary, and regular annual income payments commence. Principal is paid to the beneficiary one-third at age 25, one-half of the balance at age 30 and the remaining balance at age 35. If desired, other ages can be substituted for the ages in the Trust, or required distributions could be postponed until an older age.

If the Beneficiary does not survive to receive his or her share outright, the property passes to the Beneficiary’s descendants and, if none, to the Beneficiary’s siblings.

Note the language in paragraph 5 prohibiting the Trust funds from being used by the Trustee to satisfy the grantor’s obligation of support (if any) of the Beneficiary.

Author:

Steven G. Siegel is president of The Siegel Group, which provides consulting services to attorneys, accountants, business owners, family offices and financial planners. Based in Morristown, New Jersey, the Group provides services throughout the United States. Mr. Siegel is the author of many books, including: The Grantor Trust Answer Book (2012 and 2013 CCH); CPA’s Guide to Financial and Estate Planning (AICPA 2012); and Federal Fiduciary Income Taxation (Foxmoor 2012).

In conjunction with numerous tax planning lectures he has delivered for the National Law Foundation, Mr. Siegel has prepared extensive lecture materials on the following subjects: Planning for An Aging Population; Business Entities: Start to Finish; Preparing the Audit-Proof Federal Estate Tax Return; Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts, Introduction to Estate Planning; Intermediate-Sized Estate Planning; Social Security, Medicare and Medicaid: Explanation and Planning Strategies; Subchapter S Corporations: Using Trusts as Shareholders; Divorce and Separation: Important Tax Planning Issues; The Portability Election; Generation-Skipping Transfer Tax: A Comprehensive Review; and many other titles.

Mr. Siegel has delivered hundreds of lectures to thousands of attendees in live venues and via webinars throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including The Heckerling Institute on Tax Planning, CCH, National Law Foundation, AICPA, Western CPE, the National Society of Accountants, the National Tax Institute, Cohn-Reznick, Professional Education Systems, Inc., Foxmoor Education, many State Accounting Societies and Estate Planning Councils as well as on behalf of private companies.

He is presently serving as an adjunct professor of law in the Graduate Tax Program (LLM) of the University of Alabama, and has served as an adjunct professor of law at Seton Hall and Rutgers University law schools. Mr. Siegel holds a bachelor’s degree from Georgetown University (magna cum laude, phi beta kappa), a juris doctor from Harvard Law School and an LLM in taxation from New York University Law School.

-

5 Irrevocable Trusts (85 Pages)Special Price $185.00 Regular Price $205.00

5 Irrevocable Trusts (85 Pages)Special Price $185.00 Regular Price $205.00 -

Trusts (8 Books) - 313 PagesSpecial Price $129.00 Regular Price $160.00

Trusts (8 Books) - 313 PagesSpecial Price $129.00 Regular Price $160.00