3 Irrevocable Life Insurance Trusts (75 Pages)

SAVE when you purchase three Life Insurance Trust Forms including:

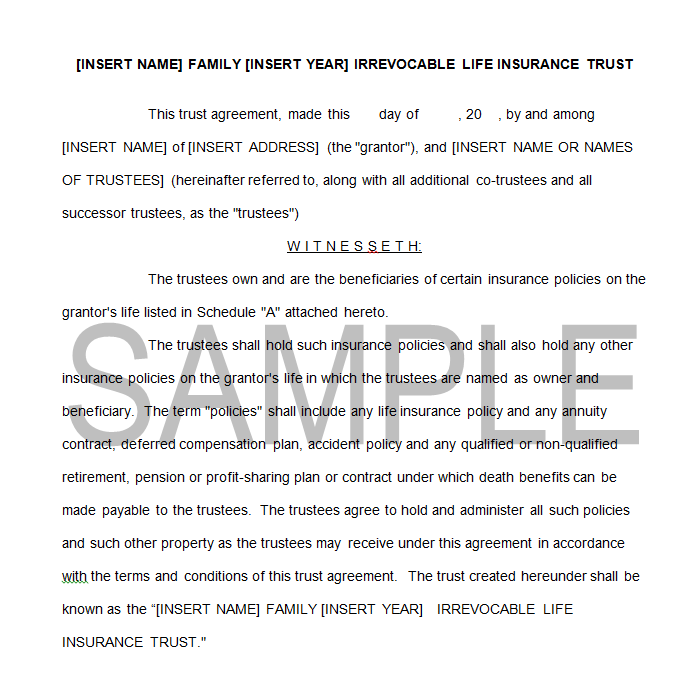

1) Irrevocable Life Insurance Trust With Crummey Powers And Sample Crummey Letter (40 Pages)

2) Irrevocable Survivorship Life Insurance Trust With Crummey Powers And Sample Crummey Letter (33 Pages)

3) Split Dollar Life Insurance Agreement (With Irrevocable Life Insurance Trust As Policy Owner) And Collateral Assignment Of The Policy To The Employer By The Trustee (11 Pages).

SAVE when you purchase 3 fully-editable Life Insurance Trust Forms including:

IRREVOCABLE LIFE INSURANCE TRUST WITH CRUMMEY POWERS AND SAMPLE CRUMMEY LETTER (40 Pages)

Two Important And Useful Additions

In this Edition, Mr. Siegel added two important and useful provisions relating to:

1. the "Uniform Gifts To Minors Act" in Article 8 and

2. specific powers about "decanting" as paragraph V. of Article 10

This is an irrevocable trust created by a grantor and funded (primarily or exclusively) by life insurance policies. The trust will be the owner and beneficiary of the life insurance policies. The intent of this trust is to remove life insurance policies from the grantor’s taxable estate if the grantor lives three years after transferring the policies to the trust – unless the trust owns the policies from their inception, in which case there is no issue with the three year look-back rule.

This trust is for the primary benefit of the grantor’s spouse for life, with the remainder payable to the grantor’s children.

The trust contains Crummey powers (Article 7 A) to enable the grantor’s payment of the life insurance premiums to qualify for the present interest gift tax exclusion. It also provides for a “safety net” QTIP Trust (Article 7 B) for the benefit of the surviving spouse just in case the insurance policies are found to be included in the grantor’s estate – they will then be paid to a trust for the surviving spouse that qualifies for the estate tax marital deduction.

Article 7 C contains the major dispositive provisions, i.e. a lifetime trust for the surviving spouse paying the spouse all of the trust income, principal in the discretion of the trustee, and giving the spouse a five and five power of withdrawal. At the second death of the spouses, the trust is divided into separate shares for the grantor’s children to be received outright at age 35. If a child has not yet attained age 35, the child’s share is held in trust until that time, with payments of income and principal within the discretion of the trustee.

Note also the provisions of Article 7 C 4, which address S corporation ownership and provide a qualifying trust arrangement, should such an arrangement become necessary.

Also included is "A Sample Notice Of Crummey Withdrawal Rights" for the trustee to send to the Crummey beneficiaries whenever a contribution is made to the trust.

IRREVOCABLE SURVIVORSHIP LIFE INSURANCE TRUST WITH CRUMMEY POWERS AND SAMPLE CRUMMEY LETTER (33 Pages)

This is an irrevocable trust whereby the grantors (generally husband and wife) transfer a survivorship (second-to-die) life insurance policy to the trust. The trust will be the owner and beneficiary of the life insurance policy. The objective is to remove the policy from the taxable estates of both spouses. This will be accomplished if the transferors live three years from the date of transfer (to the trust as owner and beneficiary) of an existing life insurance policy, or if they have the trust become the owner and beneficiary of the policy from its inception.

Note that the beneficiaries of this trust are the children of the grantors. Neither spouse should have any beneficial interest in this trust.

The trust contains a Crummey power (Article 7(B)) designed to allow premium payments made by the grantors to take advantage of the gift tax present interest exclusion. There is also a “hanging power” contained in this paragraph 7(B) to enable funds for premium payments contributed by the grantors to the trustee to be eligible for deferred withdrawal by the beneficiaries in order to avoid being treated as “lapsing powers” that would involve unwanted gift tax consequences to the beneficiaries.

Article 7(C) contains the principal dispositive provisions – here directing the division of the trust property at the second death into equal shares payable outright to the children of the grantors, and to those heirs of any predeceased child. Grandchildren of the grantors must have attained age 35 to receive their shares; otherwise, such shares are held in trust until age 35 is reached, with increments of principal payable at ages 30 and 35. There are also provisions in Article 7 to protect an S corporation election, i.e. requiring that any S corporation stock that may be in the trust pass to an eligible S corporation shareholder upon any disposition of the trust principal.

Also included is "A Sample Notice Of Crummey Withdrawal Rights" for the trustee to send to the Crummey beneficiaries whenever a contribution is made to the trust.

SPLIT DOLLAR LIFE INSURANCE AGREEMENT (WITH IRREVOCABLE LIFE INSURANCE TRUST AS POLICY OWNER) AND COLLATERAL ASSIGNMENT OF THE POLICY TO THE EMPLOYER BY THE TRUSTEE (11 PAGES)

Included herewith are two (2) Forms:

1. A Split Dollar Agreement (With Irrevocable Life Insurance Trust As Policy Owner) and

2. The Collateral Assignment Of The Policy To The Employer By The Trustee

The purpose of the Split Dollar Agreement ("SDA") is to allow an employee to have life insurance premiums paid for his or her benefit by the employer and, upon the death, or other termination, of the employee, to allow the employer to be reimbursed for the premiums paid.

In this Split Dollar Form, the owner of the policy is an irrevocable life insurance trust created by the employee. Thus, the trustee of the trust, as the policy owner, must be a party to the SDA.

In order to protect the interests of the employer to be repaid its premium outlays, the life insurance policy is collaterally assigned to the employer as security. Thus, included is the Collateral Assignment Form To The Employer By The Trustee.

Typically, the premiums advanced by the employer are treated as "loans" to the employee for which the forgone interest is taxed as compensation to the employee, which is the assumption with this Forms. However, if they wish, the employer and employee can make other arrangements to address the compensation issues.

Author:

Steven G. Siegel is president of The Siegel Group, which provides consulting services to attorneys, accountants, business owners, family offices and financial planners. Based in Morristown, New Jersey, the Group provides services throughout the United States.

Mr. Siegel is the author of many books, including: The Grantor Trust Answer Book (2012 and 2013 CCH); CPA’s Guide to Financial and Estate Planning (AICPA 2012); and Federal Fiduciary Income Taxation (Foxmoor 2012).

In conjunction with numerous tax planning lectures he has delivered for the National Law Foundation, Mr. Siegel has prepared extensive lecture materials on the following subjects: Planning for An Aging Population; Business Entities: Start to Finish; Preparing the Audit-Proof Federal Estate Tax Return; Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts, Introduction to Estate Planning; Intermediate-Sized Estate Planning; Social Security, Medicare and Medicaid: Explanation and Planning Strategies; Subchapter S Corporations: Using Trusts as Shareholders; Divorce and Separation: Important Tax Planning Issues; The Portability Election; Generation-Skipping Transfer Tax: A Comprehensive Review; and many other titles.

Mr. Siegel has delivered hundreds of lectures to thousands of attendees in live venues and via webinars throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including The Heckerling Institute on Tax Planning, CCH, National Law Foundation, AICPA, Western CPE, the National Society of Accountants, the National Tax Institute, Cohn-Reznick, Professional Education Systems, Inc., Foxmoor Education, many State Accounting Societies and Estate Planning Councils as well as on behalf of private companies.

He is presently serving as an adjunct professor of law in the Graduate Tax Program (LLM) of the University of Alabama, and has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

Mr. Siegel holds a bachelor’s degree from Georgetown University (magna cum laude, phi beta kappa), a juris doctor from Harvard Law School and an LLM in taxation from New York University Law School.