If you do any drafting of Wills and/or Revocable Trusts, you should purchase this incredible book from one of the preeminent experts on these topics, Ira Mark Bloom, Esquire. (Please see below for his curriculum vitae.)

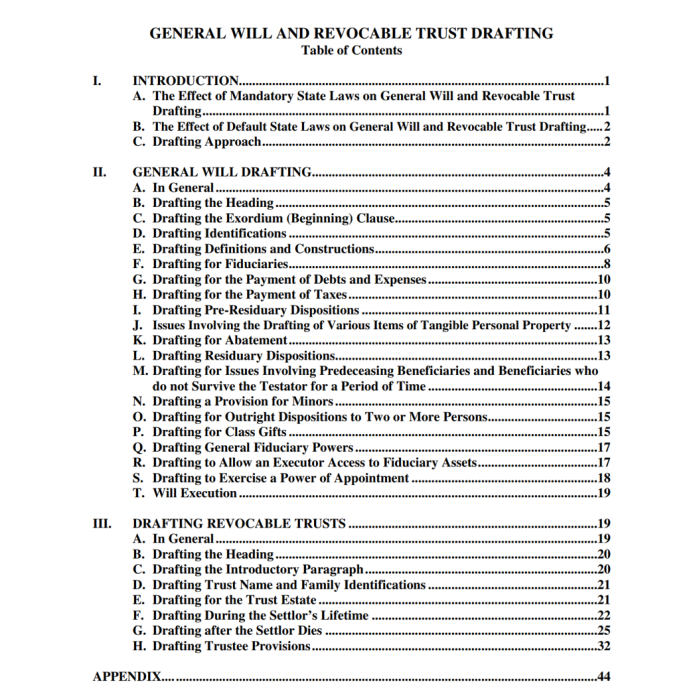

It is loaded with many important clauses for your use in your practice. Just take a look at this list:

WILL CLAUSES - 19 Pages

1. Exordium Clause

2. Family Identifications Clause

3. Definitions and Constructions Clauses

4. Fiduciaries Clauses - executor, testamentary trustees, guardians

5. Waive Bond or Other Security Clause

6. Payment of Debts and Expenses

7. Payment of Taxes

8. Pre-Residuary Dispositions

9. Tangible Personal Property

10. Abatement Clause

11. Pour-over Residuary Clause

12. Minors Clause

13. Powers and Authorizations Regarding Digital Property

14. Exercise of Power of Appointment

REVOCABLE TRUST CLAUSES - 35 Pages

1. Introduction

2. Recitals

3. Declaration Of Trust

4. Drafting During The Settlor's Lifetime - 2 Pages

a. rights reserved

b. payments during my lifetime

c. payments of debts, expenses, and taxes after my death

5. Drafting Dispositive Provisions After The Settlor Dies - 8 Pages

a. distributions after my death

b. distribution of the residuary trust estate if my (husband or wife) survives me

c. distribution of the residuary trust estate if my (husband or wife) does not survive me or if distribution

of residuary trust estate otherwise required

d. trusts for issue

e. powers of appointment

f. survival provisions

g. spendthrift provisions

h. provision for minors

6. Drafting Trustee Provisions - 5 Pages

a. successor trustee

b. provisions governing trustees

c. trustee powers

7. Drafting Miscellaneous Provisions - 4 Pages

a. generation-skipping tax provisions

b. perpetuities savings clauses

c. distributions and accumulations

d. applicable law; trust situs

e. definitions, constructions and miscellaneous matters

8. Optional Provisions - 11 Pages

a. trustee powers

b. environmental provisions

c. special business provisions

d. life insurance

Related CLE Courses: to listen to, and obtain CLE/MCLE credits in those states for which they are listed, please visit our sister sites, www.NLFonline.com (online courses) and www.NLFcle.com (courses on flash drive, CD and DVD), click on your state and scroll to these titles under the "Estate Planning & Taxation" heading: "General Will And Revocable Trust Drafting", "Powers Of Appointment: Planning And Drafting This Remarkable Device", and "The SECURE Act Big Game-Changer: Retirement Plan Distributions".

Author:

Ira Mark Bloom is the David Josiah Brewer Distinguished Professor of Law at the Albany Law School of Union University. Professor Bloom is a nationally-recognized expert in trusts and estates and estate planning. He has taught, written and lectured in the areas for over forty years. At Albany Law School he teaches a variety of subjects, including Estate Planning, Property, Trusts and Estates. He has taught at Loyola University College of Law, New Orleans, McGeorge School of Law, Tulane University School of Law, and The Ohio State University College of Law. Professor Bloom is the co-author of ten law school casebooks on tax and trusts and estates, and the principal author of the two-volume treatise Drafting New York Wills and Related Documents. Professor Bloom is an Academic Fellow of the American College of Trust and Estate Counsel (ACTEC); he currently serves on ACTEC’s Fiduciary Income Taxation, Legal Education and State Laws Committees. He is also a member of the American Law Institute and was actively involved in the formulation of the Restatement (Third) of Trusts and the Restatement (Third) of Property (Wills and other Donative Transfers). Professor Bloom is the past Chair of the Trusts and Estates Law Section, New York State Bar Association and previously served as Chair and Vice-Chair of the Taxation Committee and Chair of the Multi-State Practice Committee. He was also the Section's liaison to the EPTL-SCPA Legislative Advisory Committee which worked on recommending adoption of the Uniform Trust Code (UTC) in New York. Spearheading the study of the EPTL-SCPA Legislative Advisory Committee’s recommendation that the UTC, as modified be enacted in New York, he is currently Chair of the Section’s NYUTC Committee, a member of the NYUTC-Legislative Advisory Group’s Steering Committee and Co-Reporter for the Project. He is currently serving his second three-year term as a member of the Trusts and Estates and Surrogate’s Court Committee of the Bar of the City of New York, having also served a three-year term as member of the Estate and Gift Tax Committee of the Bar of the City of New York.