Powers Of Appointment: Planning And Drafting This Remarkable Device (48-Page Book)

In stock

SKU

2020PowersOfAppointmentBook

$39.00

Released January 3, 2020 - Written by Ira Mark Bloom, Esquire.

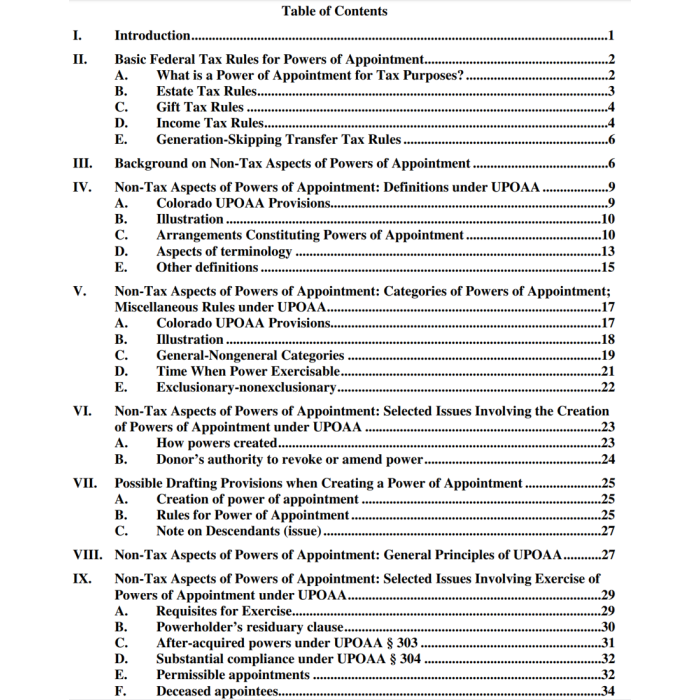

Click the above "Learn More" button to read the Table of Contents, several Sample Pages and Mr. Bloom's curriculum vitae.

"The power of appointment is the most efficient dispositive device that the ingenuity of Anglo-American lawyers has ever worked out." (W. Barton Leach, Powers of Appointment, 23 A.B.A.J. 807(1938).

As Professor Bloom writes in his book:

"Consider how the power of appointment device can be used by contemporary estate planners to achieve important non-tax dispositive goals: flexibility, control, and creditor protection. As an example, Client wants to create a testamentary trust for Client’s Child for life, and then to Client’s Grandchildren. Client does not like the rigidity that would result if the remainder interest was simply left to Grandchildren. See Trust #1 on Page A-1. Rather, he wants Child to decide up until his death how the trust principal will be enjoyed by Client’s Grandchildren.

One solution is to give Child a special (nongeneral), exclusive (exclusionary) testamentary power of appointment pursuant to which Child will name in his will who among the Client’s Grandchildren will take and in what proportions. See Trust #2 on Page A-2. In this way, the trust remains flexible until Child dies and gives Child control over the principal, and the principal cannot be reached by Child’s creditors."

If you do any estate and/or trust planning and drafting, this is an incredibly useful book which you will want to have at your fingertips. Included are many useful planning and drafting tips and warnings, numerous sample clauses and much more.

Related CLE Courses: to listen to, and obtain CLE/MCLE credits in those states for which they are listed, please visit our sister sites, www.NLFonline.com (online courses) and www.NLFcle.com (courses on flash drive, CD and DVD), click on your state and scroll to these titles under the "Estate Planning & Taxation" heading: "General Will And Revocable Trust Drafting", "Powers Of Appointment: Planning And Drafting This Remarkable Device", and "A-B Disclaimer Trusts".

Author:

Ira Mark Bloom is the David Josiah Brewer Distinguished Professor of Law at the Albany Law School of Union University. Professor Bloom is a nationally-recognized expert in trusts and estates and estate planning. He has taught, written and lectured in the areas for over forty years. At Albany Law School he teaches a variety of subjects, including Estate Planning, Property, Trusts and Estates. He has taught at Loyola University College of Law, New Orleans, McGeorge School of Law, Tulane University School of Law, and The Ohio State University College of Law. Professor Bloom is the co-author of ten law school casebooks on tax and trusts and estates, and the principal author of the two-volume treatise Drafting New York Wills and Related Documents. Professor Bloom is an Academic Fellow of the American College of Trust and Estate Counsel (ACTEC); he currently serves on ACTEC’s Fiduciary Income Taxation, Legal Education and State Laws Committees. He is also a member of the American Law Institute and was actively involved in the formulation of the Restatement (Third) of Trusts and the Restatement (Third) of Property (Wills and other Donative Transfers). Professor Bloom is the past Chair of the Trusts and Estates Law Section, New York State Bar Association and previously served as Chair and Vice-Chair of the Taxation Committee and Chair of the Multi-State Practice Committee. He was also the Section's liaison to the EPTL-SCPA Legislative Advisory Committee which worked on recommending adoption of the Uniform Trust Code (UTC) in New York. Spearheading the study of the EPTL-SCPA Legislative Advisory Committee’s recommendation that the UTC, as modified be enacted in New York, he is currently Chair of the Section’s NYUTC Committee, a member of the NYUTC-Legislative Advisory Group’s Steering Committee and Co-Reporter for the Project. He is currently serving his second three-year term as a member of the Trusts and Estates and Surrogate’s Court Committee of the Bar of the City of New York, having also served a three-year term as member of the Estate and Gift Tax Committee of the Bar of the City of New York.

We found other products you might like!

-

3 Irrevocable Life Insurance Trusts (75 Pages)Special Price $199.00 Regular Price $237.00

3 Irrevocable Life Insurance Trusts (75 Pages)Special Price $199.00 Regular Price $237.00