The intent of the SLAT is to have a spouse create a significant trust (funding it with as much (or all) of the donor’s lifetime transfer tax exemption as the donor is willing to use) for his or her spouse without qualifying the trust for the gift tax marital deduction. This makes the gift “taxable”, but if capped at or below the lifetime transfer tax exemption, no transfer tax will be due. The donee spouse will be entitled to income and principal from the trust, but the trust property will not be included in the estate of the donee spouse. When the donee spouse dies, the children of the spouses become the trust beneficiaries, either with outright distributions, or with the trust property being held in further trust. The donor spouse has now used his or her transfer tax exclusion before it may be lost in future legislation, and has removed significant property from transfer taxation over two deaths. Note that this trust is designed as a grantor trust (Article 18th), so that the donor-grantor is taxed on the trust income, but the grantor will not have an estate inclusion since the grantor powers are intentionally not extensive. If the grantor trust characterization is not desired, Article 18th can be removed.

The “risks” of this trust are that if the donee spouse dies, the donor spouse is not a trust beneficiary. If the spouses become divorced, the donee spouse has received a windfall. These risks can be addressed by the donee spouse becoming a donor of a substantial transfer to the original donor spouse, so each spouse is now the donee of a significant gift, and each spouse has utilized as much (or all) of his or her transfer tax exemption as the family is comfortable addressing. The current available exemptions have both been used, and all of the property in both of the SLATs avoids transfer tax over two deaths. This two-trust planning has its own “risk” as the trusts could be attacked as “reciprocal” if they are identical, and all of the purported transfers ignored, with no use of the transfer tax exemptions being recognized. The reciprocal trust “risk” can be overcome by having the trusts include different provisions (such as giving one spouse in one of the trusts a limited power of appointment over the trust property to children – but do not include that in the other trust). Consider using different trustees for each trust, and/or creating the two trusts in separate states.

Why Buy This Important Form?

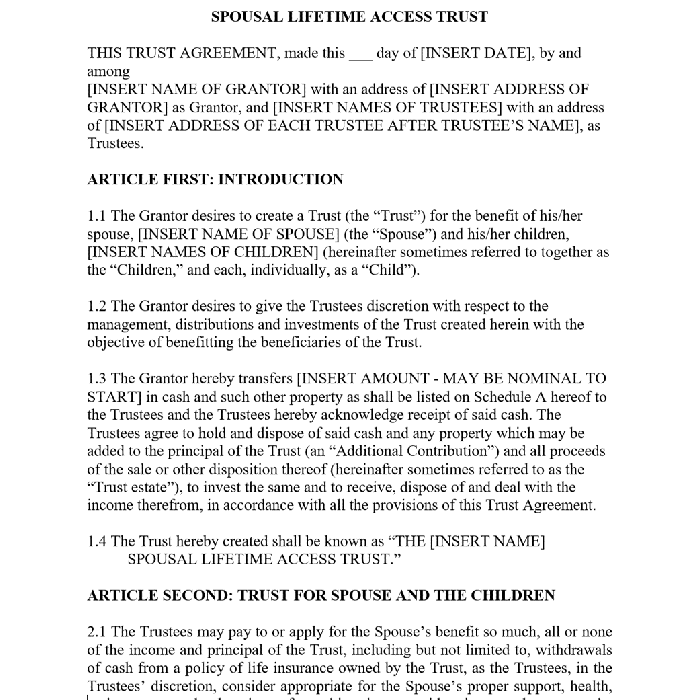

1. This is the just-released updated (post SECURE Act) SLAT. Mr. Siegel enhanced most of the provisions contained within the original, 10-page SLAT previously offered, to this new 30-page trust.

2. Mr. Siegel enhanced many of the provisions and added new provisions. Specifically, he:

– increased the powers clause options

- provided for the possibility of S Corp involvement

- addressed GST involvement if grandchildren inherit

- added supplemental needs provisions (Art 16th)

- added more definitions

- added better spendthrift clause

3. Two more especially important additions/changes are:

- including alternative provisions regarding children – do they inherit the trust property outright at the second death of their parents – or is their inheritance held in further trust? and

- making the trust a grantor trust for income tax purposes(Article 18),

so that the grantor remains the taxpayer during his/her lifetime, but the powers of the grantor fall short of estate tax inclusion.

Author:

Steven G. Siegel is president of The Siegel Group, which provides consulting services to attorneys, accountants, business owners, family offices and financial planners. Based in Morristown, New Jersey, the Group provides services throughout the United States. Mr. Siegel is the author of many books, including: The Grantor Trust Answer Book (2012 and 2013 CCH); CPA’s Guide to Financial and Estate Planning (AICPA 2012); and Federal Fiduciary Income Taxation (Foxmoor 2012).

In conjunction with numerous tax planning lectures he has delivered for the National Law Foundation, Mr. Siegel has prepared extensive lecture materials on the following subjects: Planning for An Aging Population; Business Entities: Start to Finish; Preparing the Audit-Proof Federal Estate Tax Return; Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts, Introduction to Estate Planning; Intermediate-Sized Estate Planning; Social Security, Medicare and Medicaid: Explanation and Planning Strategies; Subchapter S Corporations: Using Trusts as Shareholders; Divorce and Separation: Important Tax Planning Issues; The Portability Election; Generation-Skipping Transfer Tax: A Comprehensive Review; and many other titles.

Mr. Siegel has delivered hundreds of lectures to thousands of attendees in live venues and via webinars throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including The Heckerling Institute on Tax Planning, CCH, National Law Foundation, AICPA, Western CPE, the National Society of Accountants, the National Tax Institute, Cohn-Reznick, Professional Education Systems, Inc., Foxmoor Education, many State Accounting Societies and Estate Planning Councils as well as on behalf of private companies.

He is presently serving as an adjunct professor of law in the Graduate Tax Program (LLM) of the University of Alabama, and has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

Mr. Siegel holds a bachelor’s degree from Georgetown University (magna cum laude, phi beta kappa), a juris doctor from Harvard Law School and an LLM in taxation from New York University Law School.