3 Grantor Retained Trusts: GRAT, GRIT, and GRUT (48 Pages)

In stock

SKU

3GrantorTrusts

$199.00

SAVE when you purchase all (3) Grantor Retained Trusts:

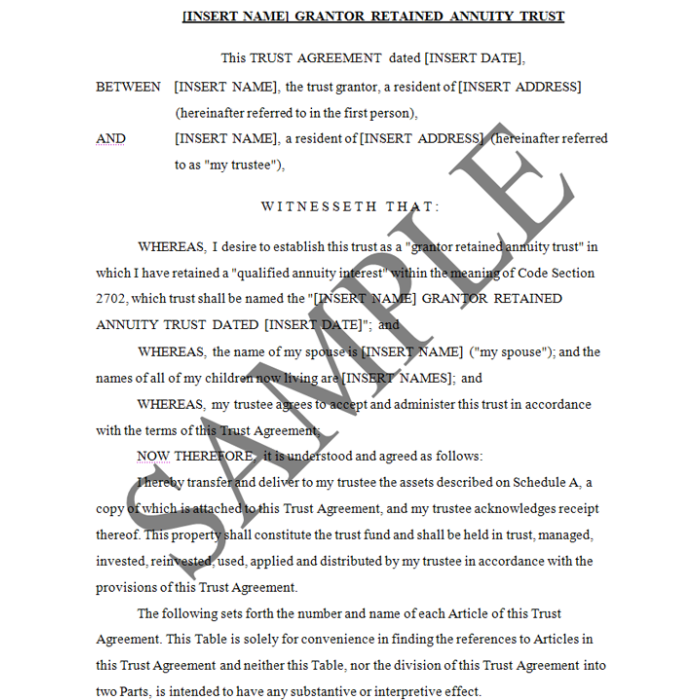

1) GRAT (Grantor Retained Annuity Trust) (32 Pages)

2) GRIT (Grantor Retained Income Trust) (8 Pages)

3) GRUT (Grantor Retained Unitrust) (8 Pages)

Click "Learn More" above for more information about our 3 Grantor Retained Trusts. Alternatively, each Trust Form may be purchased individually.

SAVE when you purchase all (3) Grantor Retained Trusts. Click any title below for additional sample pages of that form.

1) GRAT (Grantor Retained Annuity Trust) (32 Pages)

This is a form of a GRAT that is designed to qualify as a “zeroed out” i.e. no gift tax GRAT. It follows the Walton case and the IRS regulations that permit a GRAT to achieve this result. The form is divided into two Parts. Part One describes a number of provisions for the succession of the property, including a continuing trust for the children of the grantor and a fall-back marital deduction trust for the grantor’s spouse, if necessary. Part Two describes a variety of administrative provision to govern the management of the Trust.

The grantor of a GRAT may be its trustee, at least for the duration of the initial retained interest term. In entering a GRAT transaction, it is necessary to make an actuarial calculation that takes into account the desired retained interest of the grantor, the duration of the trust, the age of the grantor and the applicable federal interest rate at the time the property is transferred to the GRAT. All of these factors must be addressed if the GRAT is to be “zeroed out”, if that is the grantor’s intention.

2) GRIT (Grantor Retained Income Trust) (8 Pages)

This is a Form of a Grantor Retained Interest Trust (GRIT). It is designed to be in compliance with the rules of Code Section 2702 and the Regulations thereunder. Code Section 2702 provides that a GRIT may not be used for the benefit of “members of the Grantor’s family” as defined in that Section. Accordingly, a GRIT is used for the benefit of persons outside the definition of family members. A GRIT allows the trust Grantor to receive all or as much of the trust income as desired annually for a fixed term. This is to be distinguished from the Grantor Retained Annuity Trust (GRAT) which provides for a fixed payment to the Grantor from the commencement of the term and from a Grantor Retained Unitrust (GRUT) which provides for a fixed percentage payment to the Grantor of an annually revalued group of assets. The actuarially calculated value of the retained interest by the Grantor in the GRIT is subtracted from the value of the transferred property to determine the amount of the gift for gift tax purposes. The Grantor may provide for outright transfer or transfer into an ongoing trust for beneficiaries at the conclusion of the GRIT term. Death of the Grantor prior to the end of the GRIT term requires the inclusion of the trust property in the Grantor’s estate.

3) GRUT (Grantor Retained Unitrust) (8 Pages)

This is a Form of a Grantor Retained Unitrust (GRUT). It is designed to be in compliance with the rules of Code Section 2702 and the Regulations thereunder. A GRUT allows the trust Grantor to receive an annually adjusted payment from the trust, based on the fixed percentage determined at the outset of the trust applied to the annually determined fair market value of the trust assets. This is to be distinguished from the Grantor Retained Annuity Trust (GRAT) which provides for a fixed payment to the Grantor from the commencement of the term. The term of the GRUT may be two years or more, as desired. The value of the retained interest by the Grantor is subtracted from the value of the transferred property to determine the amount of the gift for gift tax purposes. The Grantor may provide for outright transfer or transfer into an ongoing trust for beneficiaries at the conclusion of the GRUT term.

Author:

Steven G. Siegel is president of The Siegel Group, which provides consulting services to attorneys, accountants, business owners, family offices and financial planners. Based in Morristown, New Jersey, the Group provides services throughout the United States. Mr. Siegel is the author of many books, including: The Grantor Trust Answer Book (2012 and 2013 CCH); CPA’s Guide to Financial and Estate Planning (AICPA 2012); and Federal Fiduciary Income Taxation (Foxmoor 2012). In conjunction with numerous tax planning lectures he has delivered for the National Law Foundation, Mr. Siegel has prepared extensive lecture materials on the following subjects: Planning for An Aging Population; Business Entities: Start to Finish; Preparing the Audit-Proof Federal Estate Tax Return; Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts, Introduction to Estate Planning; Intermediate-Sized Estate Planning; Social Security, Medicare and Medicaid: Explanation and Planning Strategies; Subchapter S Corporations: Using Trusts as Shareholders; Divorce and Separation: Important Tax Planning Issues; The Portability Election; Generation-Skipping Transfer Tax: A Comprehensive Review; and many other titles. Mr. Siegel has delivered hundreds of lectures to thousands of attendees in live venues and via webinars throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including The Heckerling Institute on Tax Planning, CCH, National Law Foundation, AICPA, Western CPE, the National Society of Accountants, the National Tax Institute, Cohn-Reznick, Professional Education Systems, Inc., Foxmoor Education, many State Accounting Societies and Estate Planning Councils as well as on behalf of private companies. He is presently serving as an adjunct professor of law in the Graduate Tax Program (LLM) of the University of Alabama, and has served as an adjunct professor of law at Seton Hall and Rutgers University law schools. Mr. Siegel holds a bachelor’s degree from Georgetown University (magna cum laude, phi beta kappa), a juris doctor from Harvard Law School and an LLM in taxation from New York University Law School.

2) GRIT (Grantor Retained Income Trust) (8 Pages)

This is a Form of a Grantor Retained Interest Trust (GRIT). It is designed to be in compliance with the rules of Code Section 2702 and the Regulations thereunder. Code Section 2702 provides that a GRIT may not be used for the benefit of “members of the Grantor’s family” as defined in that Section. Accordingly, a GRIT is used for the benefit of persons outside the definition of family members. A GRIT allows the trust Grantor to receive all or as much of the trust income as desired annually for a fixed term. This is to be distinguished from the Grantor Retained Annuity Trust (GRAT) which provides for a fixed payment to the Grantor from the commencement of the term and from a Grantor Retained Unitrust (GRUT) which provides for a fixed percentage payment to the Grantor of an annually revalued group of assets. The actuarially calculated value of the retained interest by the Grantor in the GRIT is subtracted from the value of the transferred property to determine the amount of the gift for gift tax purposes. The Grantor may provide for outright transfer or transfer into an ongoing trust for beneficiaries at the conclusion of the GRIT term. Death of the Grantor prior to the end of the GRIT term requires the inclusion of the trust property in the Grantor’s estate.

3) GRUT (Grantor Retained Unitrust) (8 Pages)

This is a Form of a Grantor Retained Unitrust (GRUT). It is designed to be in compliance with the rules of Code Section 2702 and the Regulations thereunder. A GRUT allows the trust Grantor to receive an annually adjusted payment from the trust, based on the fixed percentage determined at the outset of the trust applied to the annually determined fair market value of the trust assets. This is to be distinguished from the Grantor Retained Annuity Trust (GRAT) which provides for a fixed payment to the Grantor from the commencement of the term. The term of the GRUT may be two years or more, as desired. The value of the retained interest by the Grantor is subtracted from the value of the transferred property to determine the amount of the gift for gift tax purposes. The Grantor may provide for outright transfer or transfer into an ongoing trust for beneficiaries at the conclusion of the GRUT term.

Author:

Steven G. Siegel is president of The Siegel Group, which provides consulting services to attorneys, accountants, business owners, family offices and financial planners. Based in Morristown, New Jersey, the Group provides services throughout the United States. Mr. Siegel is the author of many books, including: The Grantor Trust Answer Book (2012 and 2013 CCH); CPA’s Guide to Financial and Estate Planning (AICPA 2012); and Federal Fiduciary Income Taxation (Foxmoor 2012). In conjunction with numerous tax planning lectures he has delivered for the National Law Foundation, Mr. Siegel has prepared extensive lecture materials on the following subjects: Planning for An Aging Population; Business Entities: Start to Finish; Preparing the Audit-Proof Federal Estate Tax Return; Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts, Introduction to Estate Planning; Intermediate-Sized Estate Planning; Social Security, Medicare and Medicaid: Explanation and Planning Strategies; Subchapter S Corporations: Using Trusts as Shareholders; Divorce and Separation: Important Tax Planning Issues; The Portability Election; Generation-Skipping Transfer Tax: A Comprehensive Review; and many other titles. Mr. Siegel has delivered hundreds of lectures to thousands of attendees in live venues and via webinars throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including The Heckerling Institute on Tax Planning, CCH, National Law Foundation, AICPA, Western CPE, the National Society of Accountants, the National Tax Institute, Cohn-Reznick, Professional Education Systems, Inc., Foxmoor Education, many State Accounting Societies and Estate Planning Councils as well as on behalf of private companies. He is presently serving as an adjunct professor of law in the Graduate Tax Program (LLM) of the University of Alabama, and has served as an adjunct professor of law at Seton Hall and Rutgers University law schools. Mr. Siegel holds a bachelor’s degree from Georgetown University (magna cum laude, phi beta kappa), a juris doctor from Harvard Law School and an LLM in taxation from New York University Law School.

We found other products you might like!

-

Dynasty Trust (34 Pages)Special Price $129.00 Regular Price $149.00

Dynasty Trust (34 Pages)Special Price $129.00 Regular Price $149.00