Joint Living Trust (73 Pages)

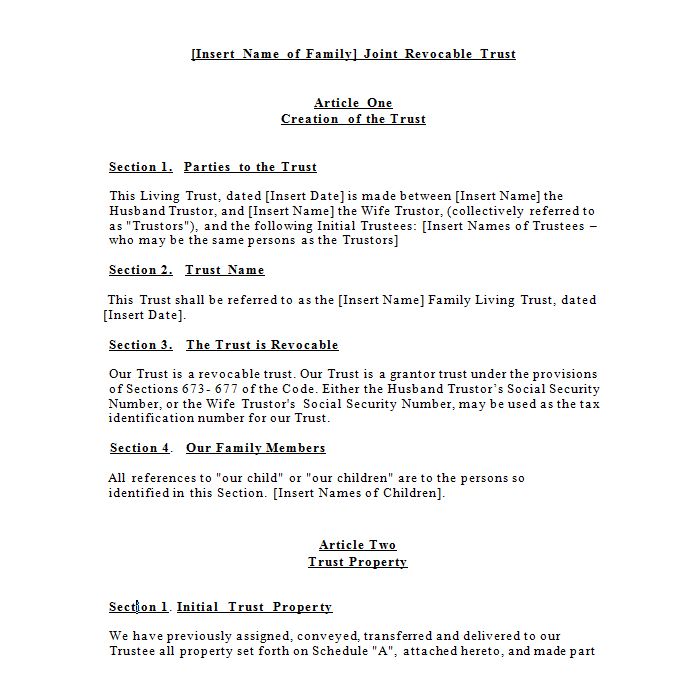

This Form is a comprehensive - 73 Page - Joint Living (Revocable) Trust created by spouses.

Click "TABLE OF CONTENTS" immediately below to see the 8-page Table Of Contents of this extensive document. Doing so will show how this trust has provisions covering virtually every conceivable contingency.

Each spouse contributes property to the trust, which is considered their own tenancy in common property, unless otherwise designated. Each spouse can revoke his or her contributive share. Each spouse has unrestricted access to his or her contributed property.

The spouses are the Trustors and Trustees of the trust. A Special Trustee may be named to protect the trust’s financial resources (Art. 3).

This Form is a comprehensive - 73 Page - Joint Living (Revocable) Trust created by spouses.

Click "TABLE OF CONTENTS" immediately below to see the 8-page Table Of Contents of this extensive document. Doing so will show how this trust has provisions covering virtually every conceivable contingency.

Each spouse contributes property to the trust, which is considered their own tenancy in common property, unless otherwise designated. Each spouse can revoke his or her contributive share. Each spouse has unrestricted access to his or her contributed property.

The spouses are the Trustors and Trustees of the trust. A Special Trustee may be named to protect the trust’s financial resources (Art. 3).

At the death of the first spouse, any appointed property is distributed, then the property is divided into a Family Trust and a Survivor’s Trust. The Family Trust is intended to hold a share of property equal to the federal applicable exclusion. The Survivor’s Trust holds the survivor’s contributed property plus any property not allocated to the Family Trust. The Family Trust should be funded with property eligible for the marital deduction, although that deduction will not necessarily be utilized. The trust property passes to children or other designated beneficiaries at the second death.

The trust includes extensive provisions for virtually every possible contingency including, for example, disclaimer by the surviving spouse; provisions for special needs beneficiaries, generation-skipping provisions, subchapter "S" stock, gifting and much more.

Here are the many important advantages Mr. Steven G. Siegel, the author of this incredibly comprehensive Form, gives for using a Joint Revocable Trust and why he does so for many of his clients:

1. Allows for Probate Avoidance

2. Protects privacy

3. Permits ease of succession of fiduciaries

4. Simplicity - use a single trust document for planning.

5. Management Advantages:

a. Protection against incapacity and avoids need to name a guardian or conservator.

b. Continuity of management for the lifetimes of both spouses.

c. Only need to manage 1 trust while both spouses are alive.

d. Avoids having to divide the family assets between the spouses and using separate trusts for each spouse - and then re-balancing assets between the two trusts during the lifetimes of the spouses.

6. Transfer tax savings at the first death - The Trust creates an easy flow of assets to fund the maximum applicable exclusion amount at the death of the first spouse to die.

7. Special opportunity for community property states: Take advantage of the unique benefit of step-up basis of all the community property of both spouses at the death of the first spouse to die. (In common law states, only property owned by the first decedent gets a basis step-up. This could be achieved in a common law state joint revocable trust by giving the first decedent a general power of appointment over the entire trust property).

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University. He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization. Contact the Siegel Group through its president, Steven G. Siegel, e-mail: [email protected].

-

Trusts (8 Books) - 313 PagesSpecial Price $129.00 Regular Price $160.00

Trusts (8 Books) - 313 PagesSpecial Price $129.00 Regular Price $160.00