California Joint Revocable (Living) Trust (47 Pages)

This Form is a joint revocable trust for spouses prepared to comply with California law. It addresses what should be done with the trust property while both spouses are alive, and how the trust property is to be administered after the death of one spouse.

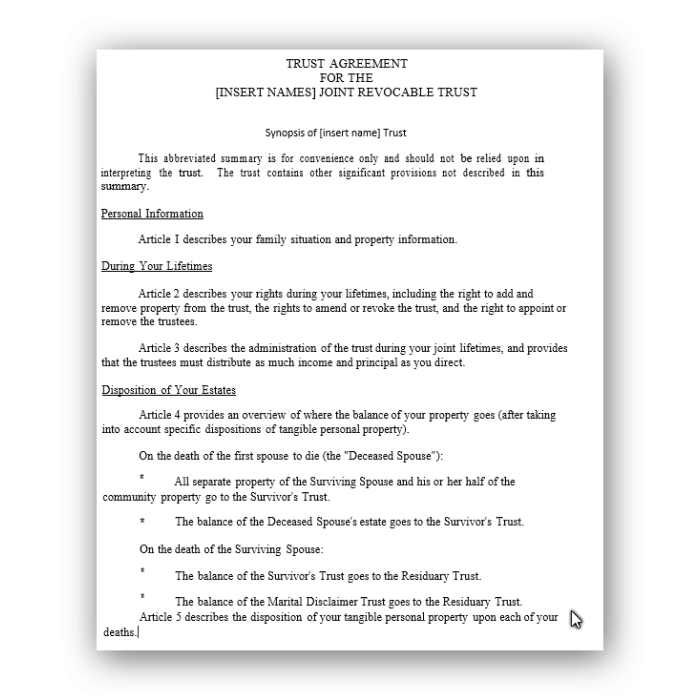

Click here - TABLE OF CONTENTS - for the 2-Page Synopsis Of Terms and the 5-Page Table of Contents.

This Form is a joint revocable trust for spouses prepared to comply with California law. It addresses what should be done with the trust property while both spouses are alive, and how the trust property is to be administered after the death of one spouse.

The Form is designed to cover a wide variety of possible situations, including disclaimers, marital and disclaimer trusts, powers of appointment, tax payment, selection of fiduciaries and much more. The Form is intended to create a flexible planning situation so that the spouses can assess and adjust their planning requirements while both are alive, and also so that there are a number of flexible options presented to the surviving spouse at the time of the first death. Provisions are also included to address the disposition of the trust property at the time of the second death.

Note that there is included with the Form a Synopsis Of The Terms Of The Trust (which may or may not be used – but clients often find it helpful) along with a Table of Contents of the trust provisions. Click here - TABLE OF CONTENTS - for the 2-Page Synopsis Of Terms and the 5-Page Table of Contents.

Author:

Steven G. Siegel is president of The Siegel Group, which provides consulting services to attorneys, accountants, business owners, family offices and financial planners. Based in Morristown, New Jersey, the Group provides services throughout the United States. Mr. Siegel is the author of many books, including: The Grantor Trust Answer Book (2012 and 2013 CCH); CPA’s Guide to Financial and Estate Planning (AICPA 2012); and Federal Fiduciary Income Taxation (Foxmoor 2012). In conjunction with numerous tax planning lectures he has delivered for the National Law Foundation, Mr. Siegel has prepared extensive lecture materials on the following subjects: Planning for An Aging Population; Business Entities: Start to Finish; Preparing the Audit-Proof Federal Estate Tax Return; Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts, Introduction to Estate Planning; Intermediate-Sized Estate Planning; Social Security, Medicare and Medicaid: Explanation and Planning Strategies; Subchapter S Corporations: Using Trusts as Shareholders; Divorce and Separation: Important Tax Planning Issues; The Portability Election; Generation-Skipping Transfer Tax: A Comprehensive Review; and many other titles. Mr. Siegel has delivered hundreds of lectures to thousands of attendees in live venues and via webinars throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including The Heckerling Institute on Tax Planning, CCH, National Law Foundation, AICPA, Western CPE, the National Society of Accountants, the National Tax Institute, Cohn-Reznick, Professional Education Systems, Inc., Foxmoor Education, many State Accounting Societies and Estate Planning Councils as well as on behalf of private companies. He is presently serving as an adjunct professor of law in the Graduate Tax Program (LLM) of the University of Alabama, and has served as an adjunct professor of law at Seton Hall and Rutgers University law schools. Mr. Siegel holds a bachelor’s degree from Georgetown University (magna cum laude, phi beta kappa), a juris doctor from Harvard Law School and an LLM in taxation from New York University Law School.