Federal Fiduciary Income Taxation - 2020 Edition (118-Page Book)

Released February 26, 2020 - Written by Steven G. Siegel.

Click the above "Learn More" button to read the Table of Contents, several Sample Pages and Mr. Siegel's curriculum vitae.

Why Buy This Book?

1. The IRS redesigned much of the 2019 Form 1041 for the 2020 filing season. This 2020 edition includes all of those changes.

2. The 2019 Form 1041 now has a third page and also has new and rearranged lines. This 2020 edition includes all of those changes.

3. The 2019 Form 1041 added new lines, etc. for the Section 199A Deduction (Qualified Business Income Deduction). This 2020 edition includes those additions.

4. Many helpful Examples are provided.

5. Many practical Planning Tips/Considerations are given.

6. The SECURE Act has kindled renewed thinking about trust drafting and trust income tax consequences. With greater use of accumulation trusts, preparation of trust tax returns will become more complicated.

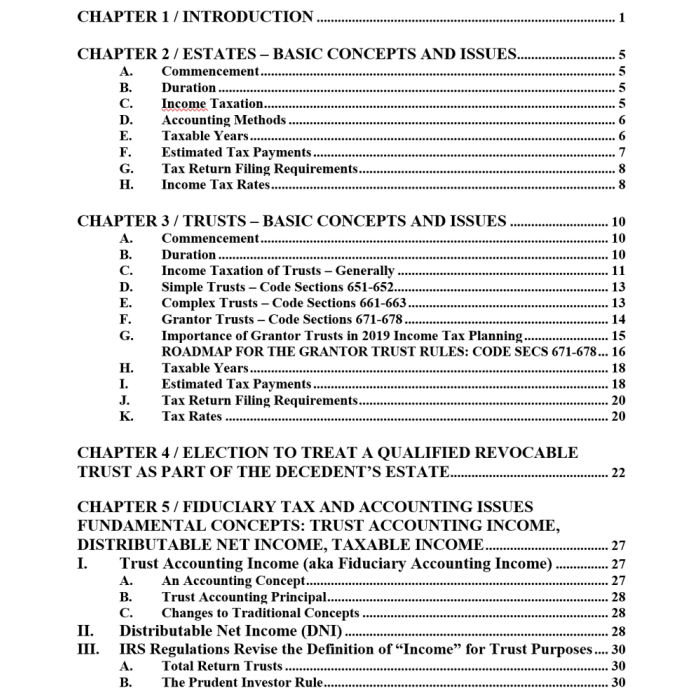

See sample pages above for the complete Table Of Contents.

Related Form(s): links to related Forms on this site appear immediately after the below "Author" curriculum vitae.

Related CLE Course: to listen to, and obtain CLE/MCLE credits in those states for which they are listed, please visit our sister sites, www.NLFonline.com (online courses) or www.NLFcle.com (courses on audio CD, flash drive and DVD), click on your state and scroll to these titles under the "Estate Planning & Taxation" heading: "The SECURE Act Big Game-Changer: Retirement Plan Distributions" and "Estate, Trust, Gift and GST Provisions of the 2017 Tax Act".

-

Dynasty Trust (34 Pages)Special Price $129.00 Regular Price $149.00

Dynasty Trust (34 Pages)Special Price $129.00 Regular Price $149.00