Irrevocable Trust For Child Or Grandchild Under IRC Sec. 2503(c) (24 Pages)

In stock

SKU

IrrevocableTrustForChildOrGrandchild

$59.00

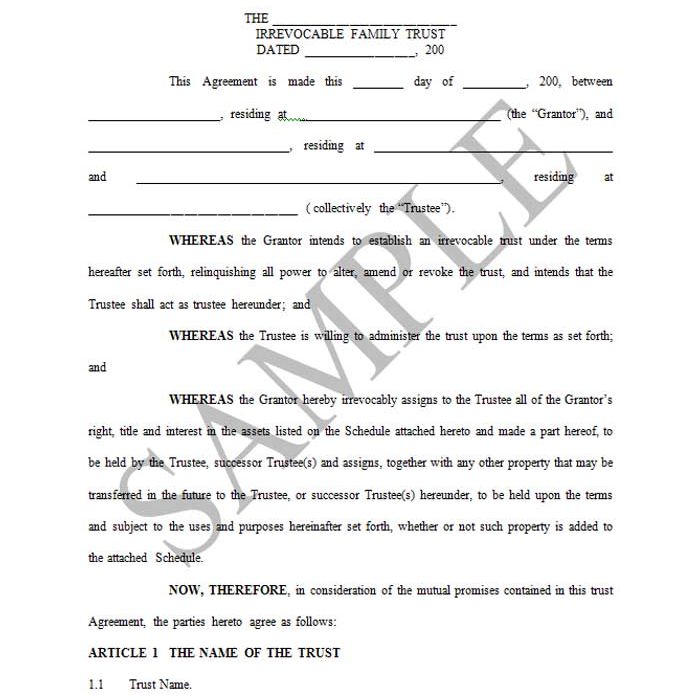

This is an irrevocable trust designed to be used by a grantor to make gifts to minor children or grandchildren.

This trust is designed to benefit multiple children or grandchildren. Each beneficiary will have a separate share in this trust. The trust is specifically designed to meet all of the requirements of Code Section 2503(c) which allows the gifts to the trust to be eligible for the grantor’s present interest gift tax exclusion, despite the fact that income and principal may be held in the trust until the beneficiary has attained age 21.

This trust is designed to benefit multiple children or grandchildren. Each beneficiary will have a separate share in this trust. The trust is specifically designed to meet all of the requirements of Code Section 2503(c) which allows the gifts to the trust to be eligible for the grantor’s present interest gift tax exclusion, despite the fact that income and principal may be held in the trust until the beneficiary has attained age 21.

This is an irrevocable trust designed to be used by a grantor to make gifts to minor children or grandchildren.

This trust is designed to benefit multiple children or grandchildren. Each beneficiary will have a separate share in this trust. The trust is specifically designed to meet all of the requirements of Code Section 2503(c) which allows the gifts to the trust to be eligible for the grantor’s present interest gift tax exclusion, despite the fact that income and principal may be held in the trust until the beneficiary has attained age 21.

Note especially the provisions of Section 2.2 B. (i) and (ii). Section B. (i) provides that at age 21, the beneficiary is entitled to all of the income and principal of the trust. This is necessary to satisfy Code Section 2503(c). However, Section B. (ii) provides that if the beneficiary does not demand in writing to be paid the trust assets within the time period indicated, the trust may continue for a longer duration in accordance with Section 2.2 (C) (age 40 has been arbitrarily chosen here). This opportunity to extend the vesting age of an otherwise qualified Section 2503(c) trust has been approved by the IRS in Rev. Rul. 74-43.

As drafted, this trust is designed to take full advantage of the full present interest exclusion gift available to each beneficiary for purposes of both the federal gift tax (Section 2503) and the federal generation-skipping tax (Section 2642(c)). The existence of separate shares for each beneficiary allows this conclusion to be drawn.

Note also: In Article 3, there is a clause addressing spendthrift protection and special needs issues. Article 6.1 anticipates that the grantor (or others) may make additional transfers to the trust. Article 6.2 contemplates additional separate shares for additional children and/or grandchildren, including those born after this trust has been put into effect.

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization. Contact the Siegel Group through its president, Steven G. Siegel, e-mail: [email protected].

We found other products you might like!

-

5 Irrevocable Trusts (85 Pages)Special Price $185.00 Regular Price $205.00

5 Irrevocable Trusts (85 Pages)Special Price $185.00 Regular Price $205.00