Trust Protector Provisions (2 Pages)

This Form is a Trust Protector clause. Many trust grantors are concerned that events will occur after a trust has been created that were unanticipated when the trust became effective. This may occur either with an irrevocable lifetime trust or with a trust that becomes effective in a person’s Will. Perhaps a beneficiary may become incapacitated or act in an unexpected or undesirable manner. Perhaps a selected trustee will prove to be a bad choice

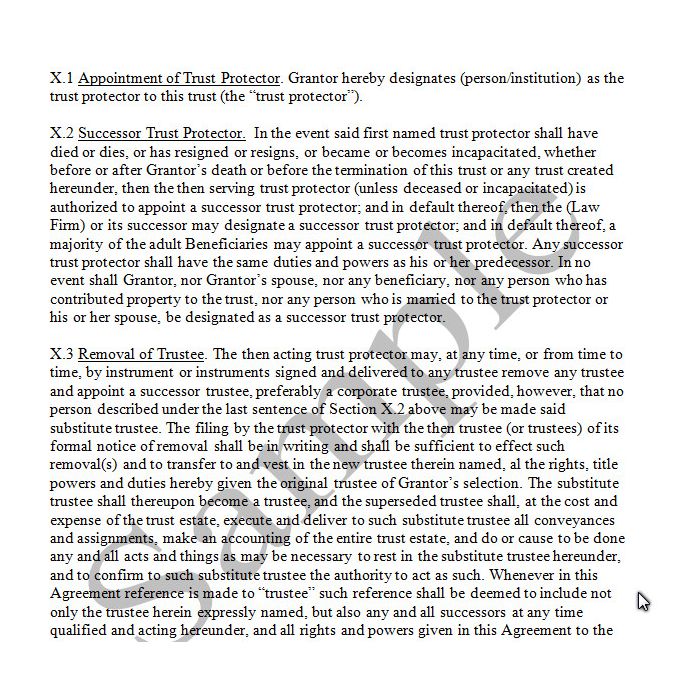

This Form is a Trust Protector clause. Many trust grantors are concerned that events will occur after a trust has been created that were unanticipated when the trust became effective. This may occur either with an irrevocable lifetime trust or with a trust that becomes effective in a person’s Will. Perhaps a beneficiary may become incapacitated or act in an unexpected or undesirable manner. Perhaps a selected trustee will prove to be a bad choice. Perhaps trust assets will not have the value the grantor expected. Many “unknowns” can be suggested. The purpose of a Trust Protector clause is to appoint a person or entity and give the appointee the authority to ‘fix” a problem that the grantor cannot fix. The major concerns of the grantor are captured in this Form – namely removal of a trustee, overseeing trust investments, and modifying certain (but not all) the terms of the trust. State law should be consulted to see if there are any special guidelines or provisions that address the scope of a trust protector’s authority.

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization. Contact the Siegel Group through its president, Steven G. Siegel, e-mail: [email protected].

-

3 Irrevocable Life Insurance Trusts (75 Pages)Special Price $199.00 Regular Price $237.00

3 Irrevocable Life Insurance Trusts (75 Pages)Special Price $199.00 Regular Price $237.00 -

12 Will Forms (168 Pages)Special Price $299.00 Regular Price $349.00

12 Will Forms (168 Pages)Special Price $299.00 Regular Price $349.00