Will With Charitable Remainder Annuity Trust (6 Pages)

FREE FORMS: In order to obtain this Free Form, please:

1. click the above "Add To Cart"

2. proceed with Checkout and then

3. if you already have an account, merely login or if you do not yet have an account, just create an account.

You do NOT need to enter any credit card information unless you are purchasing other forms.

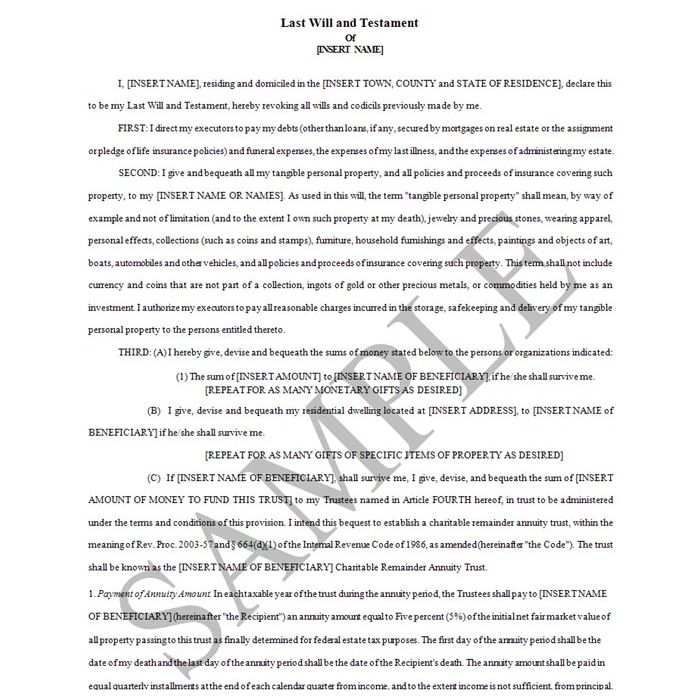

This Form is a Will prepared for an unmarried person who desired to benefit a list of family members with a series of specific gifts of money and property, and then create a charitable remainder annuity trust for the shared benefit of the life annuitant and certain charities favored by the testator.

FREE FORMS: In order to obtain this Free Form, please:

1. click the above "Add To Cart"

2. proceed with Checkout and then

3. if you already have an account, merely login or if you do not yet have an account, just create an account.

You do NOT need to enter any credit card information unless you are purchasing other forms.

This Form is a Will prepared for an unmarried person who desired to benefit a list of family members with a series of specific gifts of money and property, and then create a charitable remainder annuity trust for the shared benefit of the life annuitant and certain charities favored by the testator. Article Third (C) is the provision that contains the charitable remainder annuity trust language. Note the five percent annuity interest reserved for the life beneficiary. The designation of charities at the termination of the trust can be made by the testator, or, if desired can be selected by the trustees. To the extent the funding of the charitable remainder annuity trust coupled with the specific gifts of money and property to selected individuals does not exhaust this estate, the remainder must be disposed of. Either a gift to additional charities or to other individuals – or a combination thereof may be considered here.

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization.

Contact the Siegel Group through its president, Steven G. Siegel, e-mail: [email protected].

-

12 Will Forms (168 Pages)Special Price $299.00 Regular Price $349.00

12 Will Forms (168 Pages)Special Price $299.00 Regular Price $349.00