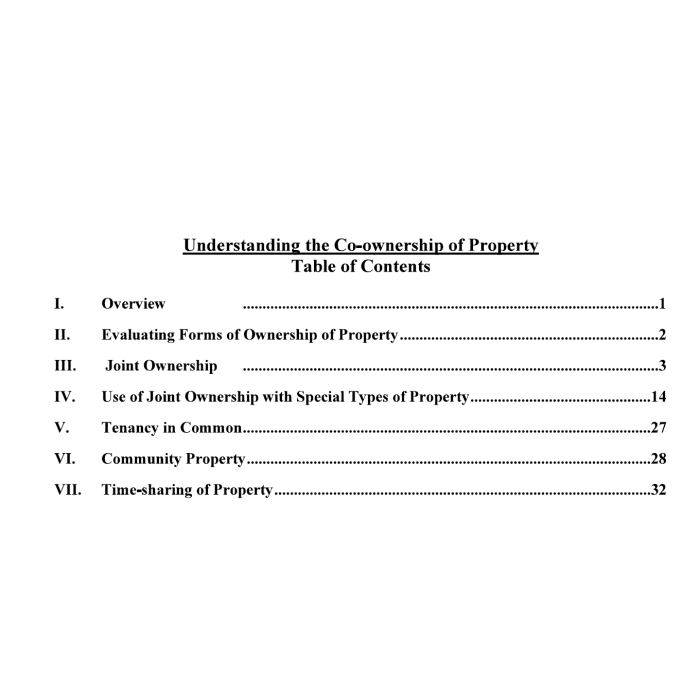

Understanding the Co-ownership of Property (34-Page Book)

Individuals often become involved in the co-ownership of property without fully realizing what it means in terms of loss of freedom and control and the costs entailed. The cost is necessarily affected by tax considerations. The planner must take into account the direct and indirect effects of tax rules on the various forms of co-ownership.

Individuals often become involved in the co-ownership of property without fully realizing what it means in terms of loss of freedom and control and the costs entailed. The cost is necessarily affected by tax considerations. The planner must take into account the direct and indirect effects of tax rules on the various forms of co-ownership.

This book addresses the common forms of ownership in which individuals may hold their homes, bank accounts, securities, and other investments. Specifically, this book examines what is probably the most common form of co-ownership — joint ownership or joint tenancy, with a right of survivorship. Special attention is focused on the special rule that permits one half of spouses’ jointly owned property to be excluded from the gross estate of the first to die, regardless of the amount of consideration furnished by each spouse. Code Section 2040(b). This book also considers a special form of joint ownership, also with a right of survivorship, between spouses, known as a tenancy by the entirety. In addition, this book examines tenancies in common, which provide no right of survivorship. Finally, this book addresses community property, which is a form of co-ownership for married couples in eight states (Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, and Washington). Wisconsin has adopted the Uniform Marital Property Act, which is similar to community property statutes.

Few individuals have property arrangements that are entirely satisfactory by estate planning tests. Assets and property rights will have been acquired in a more or less haphazard fashion, based on feelings, incomplete knowledge, custom, arrangements made by other family members, habit, and even chance. The planner must help the client recognize any consequences that might result from prior arrangements. The togetherness that can be symbolized by joint ownership or another person’s fear of togetherness can exact a price in terms of hidden costs or loss of planning flexibility. Once aware of these factors, the owners might wish to modify their earlier plans after evaluating the cost of doing so.

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. The Siegel Group does not sell any products. It is an entirely fee-based organization.