Special Needs Trust Of A Third Person's Assets Created By That Person For A Disabled (Or Other) Person (7 Pages)

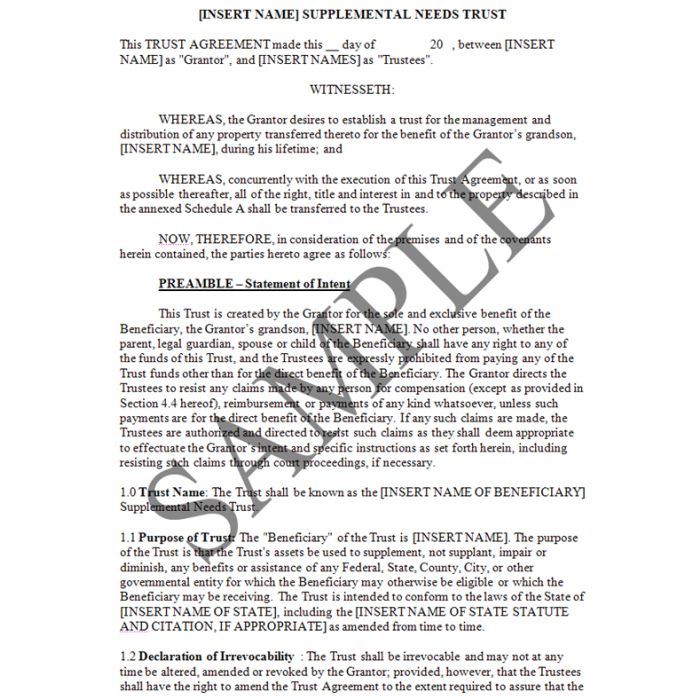

This Form is a Supplemental Needs Trust created by a third party. This means that it is the assets of the third party, not those of the beneficiary, that are being used to fund this Trust. This means that the grantor of the Trust may provide that when the Trust terminates, an alternative beneficiary may receive the balance of the remaining trust assets, if any (as opposed to the state Medicaid authorities).

PLEASE NOTE: This is the same form which was previously titled "Supplemental (aka Special) Needs Trust By Third Person". We expanded the title to better clarify this form from our other two available Special Needs Trusts. They are: "Special Needs Trust Of Disabled Person's Assets Created By The Disabled Person" and "Special Needs Trust Of Disabled Person's Assets Created By A Third Person Or Entity For The Disabled Person".

This Form is a Supplemental Needs Trust created by a third party. This means that it is the assets of the third party, not those of the beneficiary, that are being used to fund this Trust. This means that the grantor of the Trust may provide that when the Trust terminates, an alternative beneficiary may receive the balance of the remaining trust assets, if any (as opposed to the state Medicaid authorities). This Trust recites that it is created for the benefit of the grandson of the grantor. Obviously, anyone could be named beneficiary of such a Trust. Similarly, the granddaughter of the grantor is named as the successor beneficiary. Again, anyone could be named in this capacity.

As a Supplemental Needs Trust, the Trust is prohibited from being used to address the basic needs (food, clothing and shelter) of the Beneficiary which are to be provided by public assistance. The Trust funds may only be used, in the discretion of the Trustees, to address those special needs of the Beneficiary which may be necessary or desirable to supplement the Beneficiary’s quality of life which are not covered by programs of public assistance.

Note that the Trust is irrevocable and cannot be invaded by either the Beneficiary or the claims of creditors of the Beneficiary.

SUGGESTED CLE COURSE: Please note Mr. Siegel's "Social Security, Medicare And Medicaid: What You Need To Know" is currently available on audio CD and DVD at www.nlfcle.com and online at www.nlfonline.com. On both of these web sites, click on your state (or any state if you do not care about earning CLE credits) and scroll down to the course title which appears under the heading "Other".

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization. Contact the Siegel Group through its president, Steven G. Siegel, e-mail: [email protected].