Irrevocable Lifetime Trust With Limited Power Of Appointment And Crummey Power (15 Pages)

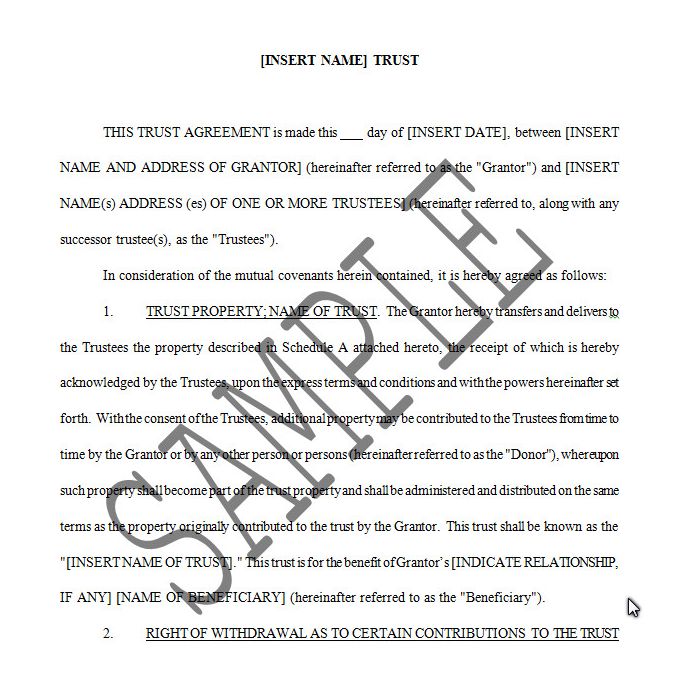

This is a Form of an irrevocable trust. It is intended to continue for the lifetime of the Beneficiary. At the death of the Beneficiary, the Beneficiary is given a limited power of appointment to appoint the property as the Beneficiary wishes without requiring inclusion of the appointed property in the estate of the Beneficiary (a limited power of appointment). In default of the Beneficiary’s exercise of this power, the remaining trust property passes outright to the descendants of the Beneficiary, unless they are minors or legally incompetent, in which case the provision of paragraph 4 apply.

The trustees are permitted to distribute income and principal to the Beneficiary at any time in accordance with an ascertainable standard – for health, education, maintenance and support. Liberal application of this standard could result in having the entire trust property distributed to the Beneficiary during his or her lifetime, leaving no remainder for descendants.

This is a Form of an irrevocable trust. It is intended to continue for the lifetime of the Beneficiary. At the death of the Beneficiary, the Beneficiary is given a limited power of appointment to appoint the property as the Beneficiary wishes without requiring inclusion of the appointed property in the estate of the Beneficiary (a limited power of appointment). In default of the Beneficiary’s exercise of this power, the remaining trust property passes outright to the descendants of the Beneficiary, unless they are minors or legally incompetent, in which case the provision of paragraph 4 apply.

The trustees are permitted to distribute income and principal to the Beneficiary at any time in accordance with an ascertainable standard – for health, education, maintenance and support. Liberal application of this standard could result in having the entire trust property distributed to the Beneficiary during his or her lifetime, leaving no remainder for descendants.

Paragraph 2 of the Form is a Crummey power of withdrawal. If the trust will be funded by annual contributions, this will allow them to qualify as present interest gifts within the limits of the federal gift tax rules. If there is concern that the Beneficiary may exercise the Crummey right of withdrawal in a manner that is not desired, this provision may be stricken.

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization.

Contact the Siegel Group through its president, Steven G. Siegel, e-mail: [email protected].

-

5 Irrevocable Trusts (85 Pages)Special Price $185.00 Regular Price $205.00

5 Irrevocable Trusts (85 Pages)Special Price $185.00 Regular Price $205.00 -

3 Irrevocable Life Insurance Trusts (75 Pages)Special Price $199.00 Regular Price $237.00

3 Irrevocable Life Insurance Trusts (75 Pages)Special Price $199.00 Regular Price $237.00