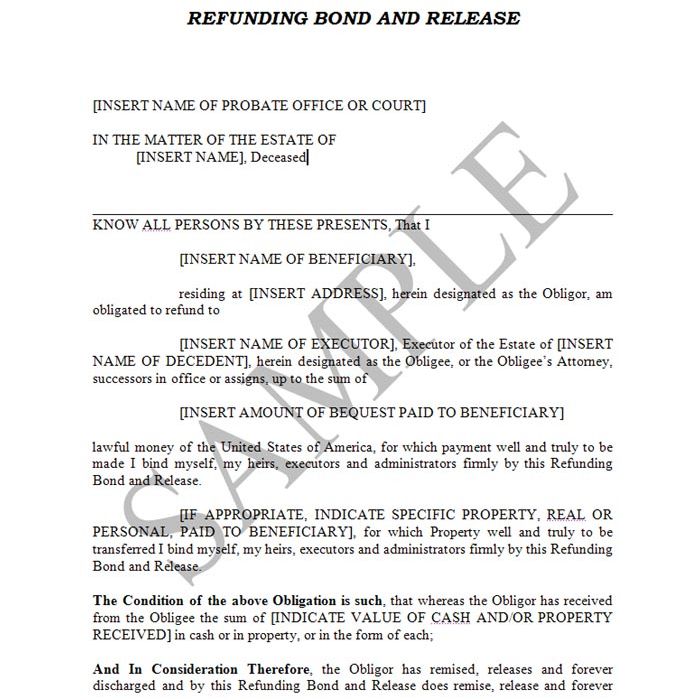

Refunding Bond and Release (3 Pages)

This is a Form of Refunding Bond and Release. It is used in the settlement of an estate. It typically accompanies a payment from a fiduciary to a beneficiary of an estate or trust. The purpose of this Form is to have the beneficiary acknowledge receipt of a distribution from the fiduciary; while at the same time agreeing to repay (proportionately) the inheritance advanced to the beneficiary by the fiduciary should repayment become necessary.

This is a Form of Refunding Bond and Release. It is used in the settlement of an estate. It typically accompanies a payment from a fiduciary to a beneficiary of an estate or trust. The purpose of this Form is to have the beneficiary acknowledge receipt of a distribution from the fiduciary; while at the same time agreeing to repay (proportionately) the inheritance advanced to the beneficiary by the fiduciary should repayment become necessary.

This Form is intended to protect the fiduciary in the event there is a subsequent claim made against the decedent’s estate - after the fiduciary has distributed all of the estate’s assets. Its use gives the fiduciary recourse against the beneficiaries of the estate should there be a claim by a third party that must be satisfied. The claim may come from a taxing authority or from a creditor.

This Form, possibly in conjunction with a Waiver of Accounting, allows the fiduciary to have “closure” of the estate or trust’s administration.

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization.

Contact the Siegel Group through its president, Steven G. Siegel, e-mail: [email protected].