Deeds: Administrator's, Bargain and Sale With Covenants, Bargain and Sale Without Covenants, Executor's, Quitclaim, and Warranty - New York Forms (12 Pages)

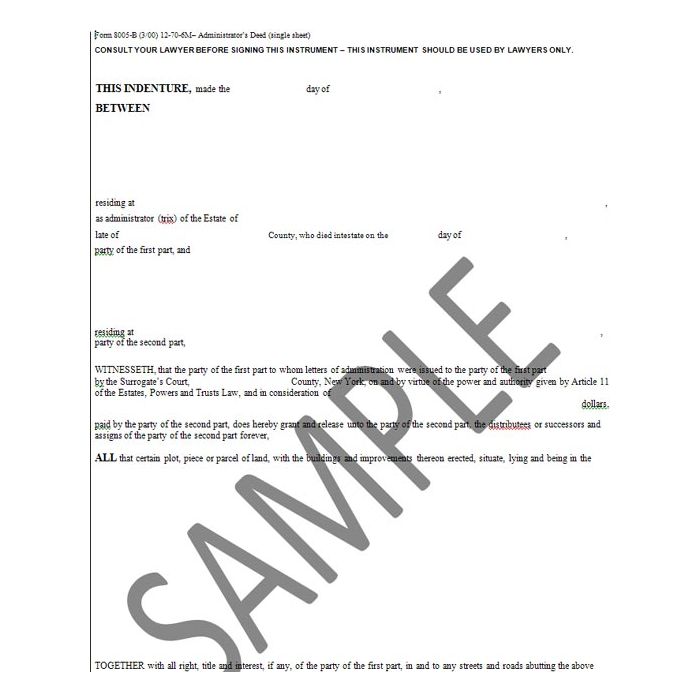

Administrator's Deed

An Administrator’s deed must be used to transfer the property of a person who has died intestate, leaving no Will.

Bargain and Sale With Covenants

The Bargain and Sale Deed with Covenant may be used to transfer property pursuant to an arm’s length Contract of Sale.

The “Covenant” printed in the boiler-plate of this Deed assures that “…the party of the first part, (the Seller) covenants that the party of the first part has not done or suffered anything whereby the premises have been encumbered in any way whatever…”.

Bargain and Sale Without Covenants

This Bargain and Sale Deed contains the same text as found in the Bargain and Sale Deed with covenants omitting from the text only “…the party of the first part, covenants that the party of the first part has not done or suffered anything whereby the said premises have been encumbered in any way whatsoever…”.

Executor's Deed

An Executor’s deed must be used to transfer the property of a person has died leaving a Will which has been offered for Probate in the Surrogate’s Court located in the County of the deceased’s residence.

Quitclaim Deed

This deed conveys only the interest which the grantor may have. It contains no warranties or representations that grantor has any interest, but if the grantor does, the Quitclaim Deed conveys that interest.

Warranty Deed

This Deed warranties that the premises have not been encumbered in any way. It warranties the title and the right of grantor to convey. It assures grantee’s the right to quiet enjoyment of the property. This form of Deed may visciate the need for title insurance.

Administrator's Deed

An Administrator’s deed must be used to transfer the property of a person who has died intestate, leaving no Will. The Surrogate’s Court located in the County of the deceased’s residence, pursuant to statutory authority, appoints a fiduciary, known as the Administrator of the estate. The Administrator is authorized by Court issued Letters of Administration to manage the estate’s assets.

This deed must reflect the full consideration paid for this sale. As in the Bargain and Sale Deed with Covenant, the deed contains a covenant that the party of the first part (the Court appointed Administrator) has not done or suffered anything whereby the premises have become encumbered.

The deed contains the metes and bounds description found in the prior deed of record or in Schedule A of the Title Report.

Bargain and Sale With Covenants

The Bargain and Sale Deed with Covenant may be used to transfer property pursuant to an arm’s length Contract of Sale.

The “Covenant” printed in the boiler-plate of this Deed assures that “…the party of the first part, (the Seller) covenants that the party of the first part has not done or suffered anything whereby the premises have been encumbered in any way whatever…”.

Since buyers purchase title insurance to assure against encumbrances, liens, judgments, etc., this form of deed, in effect, enables buyer’s chosen title insurance company to subrogate against Seller in the event that there is a claim made against the title company for failure to locate and report an existing encumbrance.

I do not recommend that Seller’s attorney agree in the Sales contract to the transferring of a Bargain and Sale Deed with Covenant (unless failure to provide this form of Deed would be a deal breaker) because Seller is vulnerable in case of a title company ‘s failure to identify an existing encumbrance.

Attached to the deed will be a metes and bounds description taken exactly from the prior deed of record or the Title Company’s Schedule A metes and bounds description.

Bargain and Sale Without Covenants

This Bargain and Sale Deed contains the same text as found in the Bargain and Sale Deed with covenants omitting from the text only “…the party of the first part, covenants that the party of the first part has not done or suffered anything whereby the said premises have been encumbered in any way whatsoever…”.

When this Bargain and Sale Deed form is used and the title company, in its search, misses a judgment creditor or other lien or encumbrance against the property, the liability is solely that of the title insurance company with no right of subrogation against Seller, even if Seller was aware of such objection to clear title.

The deed contains the metes and bounds description of the property being conveyed taken from the prior Deed of record or the Schedule A metes and bounds description found in the Title Report.

Executor's Deed

An Executor’s deed must be used to transfer the property of a person has died leaving a Will which has been offered for Probate in the Surrogate’s Court located in the County of the deceased’s residence. The Testator appoints a fiduciary, known as the Executor or of the estate. The Executor is authorized by Court issued Letters Testamentary, to manage the estate’s assets.

This deed must reflect the full consideration paid for this sale. As in a Bargain and Sale Deed with Covenant, the deed contains a covenant that the party of the first part (the Executor appointed pursuant to probated Will) has not done or suffered anything whereby the premises have become encumbered.

The deed contains the metes and bounds description of the property to be conveyed described in the prior deed of record or in Schedule A of the Title Report.

Quitclaim Deed

This deed conveys only the interest which the grantor may have. It contains no warranties or representations that grantor has any interest, but if the grantor does, the Quitclaim Deed conveys that interest.

It is imperative that grantee order a title search and insurance assuring that grantor is in title, that title is not defective and can be conveyer. The search will disclose encumbrances, liens, judgments, etc. which if not cleared up may diminish the value of any interest conveyed.

Attached to the deed will be a metes and bounds description taken exactly from the prior deed of record or the Title Company’s Schedule A metes and bounds description.

Warranty Deed

Neither the Warranty Deed nor the Full Covenant and Warranty Deed are used with any frequency in New York.

This Deed warranties that the premises have not been encumbered in any way. It warranties the title and the right of grantor to convey. It assures grantee’s the right to quiet enjoyment of the property. This form of Deed may visciate the need for title insurance.

Attached to the deed will be a metes and bounds description taken exactly from the prior deed of record.

Author:

CLAIRE SAMUELSON MEADOW, Esq. is in the private practice of law, concentrating in real property transactions. In addition, she works on title matters as a consultant, attorney and representative for a New York based title agency. She is the author of numerous real estate articles distributed to lawyers, and she has appeared on the General Practice “Hot Tips” panel at the New York State Bar Association’s Annual Meeting. Recently, she has been presenting Continuing Legal Education-credit programs on real estate and title matters to the Westchester County Bar Association, the New York County Bar Association and the National Law Foundation. Mrs. Meadow authored the residential real property chapters of the New York Lawyer’s Deskbook and Formbook for more than 12 years.

Before entering private practice, Mrs. Meadow was a staff attorney in the Enforcement Division of the Securities and Exchange Commission’s New York regional office. She is a Phi Beta Kappa, cum laude graduate of Hunter College, Class of 1959, and a graduate of Columbia Law School, Class of 1962, where she was a recipient of a Moot Court Scholarship.

Mrs. Meadow is listed in Who’s Who in American Women and Who’s Who in American Law. She is a recipient of a Westchester County Woman of Achievement Award and a Certificate of Special Congressional Recognition from Congresswoman Nita M. Lowey for “outstanding and invaluable service to the community.”

Mrs. Meadow was a founding member of the New York State Women’s Bar Association, Westchester County, and its first recording secretary. She is also a member of the New York State Bar Association, Real Property Committee; the Westchester County Bar Association; and the New Rochelle Bar Association.

Don’t think this attorney has a narrow horizon. She chaired the Westchester Women’s Bar Association Annual Golf Outing for six years causing it to become such a popular community event that, in some years players had to be turned away.

Mrs. Meadow welcomes inquiries by new lawyers and general practitioners concerning basic real estate or title matters. She may be contacted at 914-834-6472.