Buy-Sell Stockholders' Agreement: Entity Purchase (19 Pages)

In stock

SKU

EntityPurchaseStockholdersAgreement

$59.00

Mr. Siegel, who wrote, and uses for his clients, this Form, advises that these buy-sell agreements are now more attractive to clients. Specifically, he says:

"Since the 2017 Act repealed the corporate alternative minimum tax, the prior law making life insurance payments owned by a corporation and collected at death to facilitate a buy-sell an AMT tax preference is over. That discouraged some C corporation entity purchases. They may be more favorable now."

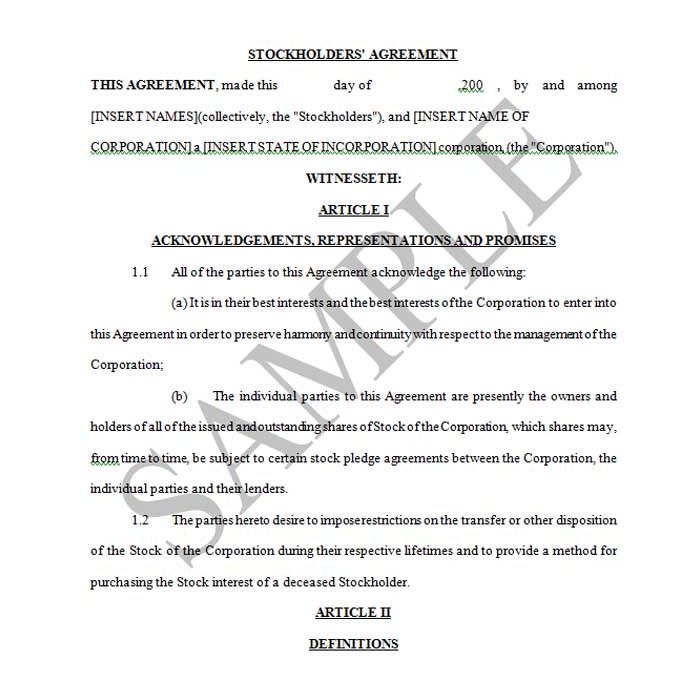

This is an entity purchase Stockholders’ Agreement whereby the Corporation is the purchaser of the stock of a deceased or disabled stockholder. The Agreement addresses a number of situations where a stockholder may wish to sell his or her stock, namely a sale to a third party, death and permanent disability. Article IV gives the corporation first, then the remaining stockholders, a right of first refusal to purchase the shares of a stockholder wishing to sell. Note that the price indicated here for the “insiders” to buy is the lesser of the third-party offered price or the agreed-upon price for the stock included in the Agreement. If desired, that could be changed to force the insiders to meet the offered price.

This is an entity purchase Stockholders’ Agreement whereby the Corporation is the purchaser of the stock of a deceased or disabled stockholder. The Agreement addresses a number of situations where a stockholder may wish to sell his or her stock, namely a sale to a third party, death and permanent disability. Article IV gives the corporation first, then the remaining stockholders, a right of first refusal to purchase the shares of a stockholder wishing to sell. Note that the price indicated here for the “insiders” to buy is the lesser of the third-party offered price or the agreed-upon price for the stock included in the Agreement. If desired, that could be changed to force the insiders to meet the offered price.

This is an entity purchase Stockholders’ Agreement whereby the Corporation is the purchaser of the stock of a deceased or disabled stockholder. The Agreement addresses a number of situations where a stockholder may wish to sell his or her stock, namely a sale to a third party, death and permanent disability. Article IV gives the corporation first, then the remaining stockholders, a right of first refusal to purchase the shares of a stockholder wishing to sell. Note that the price indicated here for the “insiders” to buy is the lesser of the third-party offered price or the agreed-upon price for the stock included in the Agreement. If desired, that could be changed to force the insiders to meet the offered price.

Mr. Siegel, who wrote, and uses for his clients, this Form, advises that these buy-sell agreements are now more attractive to clients. Specifically, he says:

"Since the 2017 Act repealed the corporate alternative minimum tax, the prior law making life insurance payments owned by a corporation and collected at death to facilitate a buy-sell an AMT tax preference is over. That discouraged some C corporation entity purchases. They may be more favorable now."

Articles V (death) and VI (disability) require the Corporation to buy out the stockholder’s interest should either of these events occur. The stock is priced using the Certificate of Value method (Article VII). If desired, a formula or an appraisal could be substituted here. The terms of purchase contemplate the Corporation owning life or disability insurance on the stockholders (Article XII) which would be applied toward the purchase price. A withdrawing stockholder is given the opportunity to acquire a corporate-owned insurance policy. (Article XIII). Provision is made for both excess insurance proceeds (the corporation retains) and insufficient insurance proceeds (a Note arrangement) to satisfy the purchase obligation (Article VIII). Protection is included in the Agreement in the event the corporation is an S corporation. (Article XI).

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization. Contact the Siegel Group through its president, Steven G. Siegel, e-mail: [email protected].

We found other products you might like!