2 Disability Forms (12 Pages)

Disability Buyout Agreement (6 Pages)

This Form is a Disability Buyout Agreement. It is designed to allow the purchase of the interest of a person who has an ownership interest in a business enterprise in the event of his or her total disability. It is often (but not always) funded in whole or in part by a disability insurance policy.

Disability Insurance Reimbursement Plan (6 Pages)

This Form is a Disability Insurance Reimbursement Plan to be provided by an employer to selected employees. It is designed to allow the employee to pay for his or her own disability insurance on an annual basis...

Alternatively, each form is available for individual purchase. Click the desired title above or select Employment/Labor Law on the homepage of www.NLFforms.com.

Disability Buyout Agreement (6 Pages)

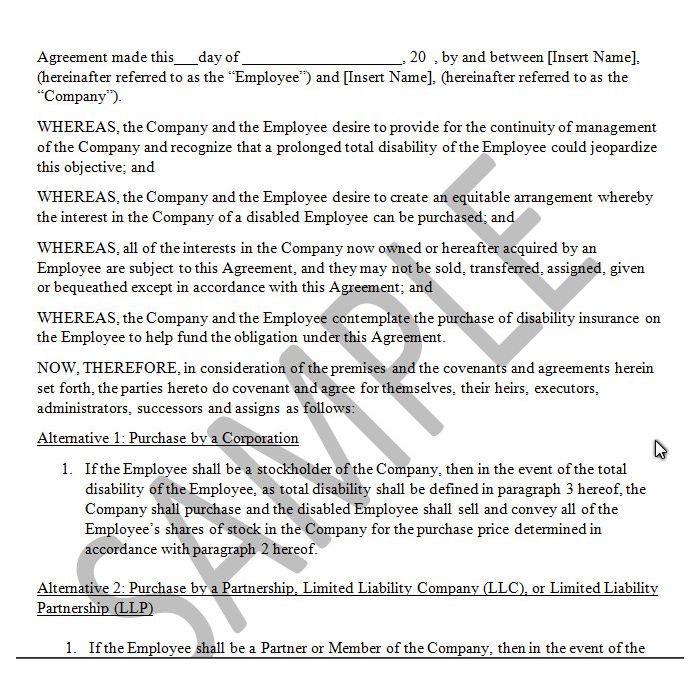

This Form is a Disability Buyout Agreement. It is designed to allow the purchase of the interest of a person who has an ownership interest in a business enterprise in the event of his or her total disability. It is often (but not always) funded in whole or in part by a disability insurance policy. The Form is designed to address various forms of business – corporation, partnership, LLC, LLP. Note that several paragraphs present alternatives to be selected, depending on the type of entity involved and whether the buyout will be addressed by the entity or the other owners (paragraph 1) and how the ownership interest will be valued (paragraph 2). There are also alternatives suggested for how the buyout may be paid. For convenience, the parties in this Form have been called “Company” and “Employee”. This can be modified, if desired, to recognize the specific type of entity being addressed and the specific status of a member of that entity.

Disability Insurance Reimbursement Plan (6 Pages)

This Form is a Disability Insurance Reimbursement Plan to be provided by an employer to selected employees. It is designed to allow the employee to pay for his or her own disability insurance on an annual basis – and if the employee does become disabled, there is no Company insurance reimbursement, thus allowing the employee to be the payer of the insurance and allowed to treat any insurance proceeds as tax-free under Code Sections 105 and 106. If the employee was not disabled for a given year, then the employer makes a non-taxable reimbursement of the insurance premium paid by the employee in the following year.

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization. Contact the Siegel Group through its president, Steven G. Siegel, e-mail: [email protected].

-

Employment/Labor Law (10 Books) - 406 PagesSpecial Price $115.00 Regular Price $181.00

Employment/Labor Law (10 Books) - 406 PagesSpecial Price $115.00 Regular Price $181.00 -

24 Employment/Labor Law Forms (24 Forms, 170 Pages)Special Price $449.00 Regular Price $656.00

24 Employment/Labor Law Forms (24 Forms, 170 Pages)Special Price $449.00 Regular Price $656.00