Issue #2: After The Tax Cuts And Jobs Act - Clauses to Address the Proper Notices of Allocation to Use in Connection with Generation-Skipping Transfers - 5 Clauses (2 Pages)

Issue #2: Clauses to Address the Proper Notices of Allocation to Use in Connection with Generation-Skipping Transfers

Clause 1: Basic Notice of Allocation of GST Exclusion

Clause 2: Election Out of Automatic GST Exclusion Allocation

a. For Transfers in a Particular Year to a Particular Trust

b. For Transfers for a Particular Transfer to a Particular Trust

c. For All Transfers to a Particular Trust

d. For all Transfers to any GST Trust

Clause 3: Termination of Prior Election Out of Notice of Automatic GST Exclusion

Clause 4: Election to Apply GST Exclusion to a GST Trust

Clause 5: Late Allocation of the GST Exclusion

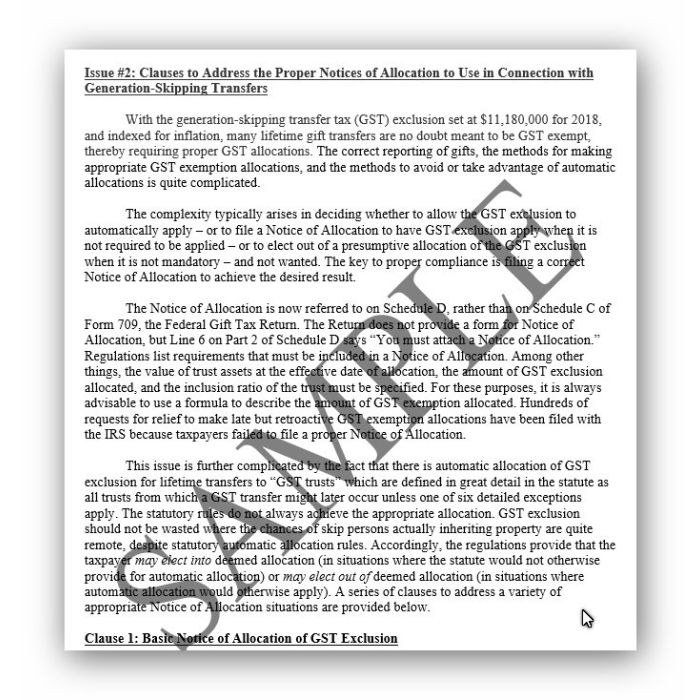

Issue #2: Clauses to Address the Proper Notices of Allocation to Use in Connection with Generation-Skipping Transfers

Clause 1: Basic Notice of Allocation of GST Exclusion

Clause 2: Election Out of Automatic GST Exclusion Allocation

a. For Transfers in a Particular Year to a Particular Trust

b. For Transfers for a Particular Transfer to a Particular Trust

c. For All Transfers to a Particular Trust

d. For all Transfers to any GST Trust

Clause 3: Termination of Prior Election Out of Notice of Automatic GST Exclusion

Clause 4: Election to Apply GST Exclusion to a GST Trust

Clause 5: Late Allocation of the GST Exclusion

The passage of the 2017 Tax Cuts and Jobs Act has heralded a new era in estate planning. The greatly increased transfer tax exclusion to $11.18 million, indexed for inflation, is effective from 2018 through 2025, when it is suspended, and returns to the 2017 levels, indexed for inflation. Taking into account political risk, the opportunity to take advantage of the 2017 law could be a once in a lifetime opportunity. Portability is retained. Estate tax planning is “simplified” for many people. Seeking optimal income tax basis adjustments is a goal for everyone.

That said, however, for many people, the need for trusts and more sophisticated planning may not be just a matter of tax planning. That has been simplified. However, issues of asset protection, management, blended families, state death taxes, providing for multi-generations of a family, etc. have not vanished with the passage of the 2017 Act. Instead, planners now have more options to present to clients – options that require careful selection and preparation of the Forms needed to address a wide variety of planning issues.

Alternatively, save when you purchase all Clauses For Estate Planning Opportunities After The Tax Cuts and Jobs Act (45 Pages).

Author:

Steven G. Siegel is president of The Siegel Group, which provides consulting services to attorneys, accountants, business owners, family offices and financial planners. Based in Morristown, New Jersey, the Group provides services throughout the United States. Mr. Siegel is the author of many books, including: The Grantor Trust Answer Book (2012 and 2013 CCH); CPA’s Guide to Financial and Estate Planning (AICPA 2012); and Federal Fiduciary Income Taxation (Foxmoor 2012). In conjunction with numerous tax planning lectures he has delivered for the National Law Foundation, Mr. Siegel has prepared extensive lecture materials on the following subjects: Planning for An Aging Population; Business Entities: Start to Finish; Preparing the Audit-Proof Federal Estate Tax Return; Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts, Introduction to Estate Planning; Intermediate-Sized Estate Planning; Social Security, Medicare and Medicaid: Explanation and Planning Strategies; Subchapter S Corporations: Using Trusts as Shareholders; Divorce and Separation: Important Tax Planning Issues; The Portability Election; Generation-Skipping Transfer Tax: A Comprehensive Review; and many other titles. Mr. Siegel has delivered hundreds of lectures to thousands of attendees in live venues and via webinars throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including The Heckerling Institute on Tax Planning, CCH, National Law Foundation, AICPA, Western CPE, the National Society of Accountants, the National Tax Institute, Cohn-Reznick, Professional Education Systems, Inc., Foxmoor Education, many State Accounting Societies and Estate Planning Councils as well as on behalf of private companies. He is presently serving as an adjunct professor of law in the Graduate Tax Program (LLM) of the University of Alabama, and has served as an adjunct professor of law at Seton Hall and Rutgers University law schools. Mr. Siegel holds a bachelor’s degree from Georgetown University (magna cum laude, phi beta kappa), a juris doctor from Harvard Law School and an LLM in taxation from New York University Law School.