SAVE when you purchase 3 Subchapter S Trust Forms which includes: Electing Small Business Trust (13 Pages), Qualified Subchapter S Trust (16 Pages), and Voting Trust Agreement (14 Pages). Click any of the three titles below for a complete form description or to purchase a form individually.

The 2017 Act liberalized some of the rules for one of the permitted trust arrangements – beginning in 2018, the charitable contribution deduction of an ESBT is not determined by the rules generally applicable to trusts but, rather, by the much more favorable rules applicable to individuals. In addition, before the 2017 Act, only U.S. residents could be shareholders of an S corporation. The Act permits nonresident aliens to be beneficiaries of an Electing Small Business Trust (“ESBT”) that is a shareholder of an S corporation. The S corporation stock held by the ESBT may not, itself, be distributed to the nonresident alien without terminating the S corporation election, but the ESBT opportunity may now be more widely used as it can apply to many more potential beneficiaries.

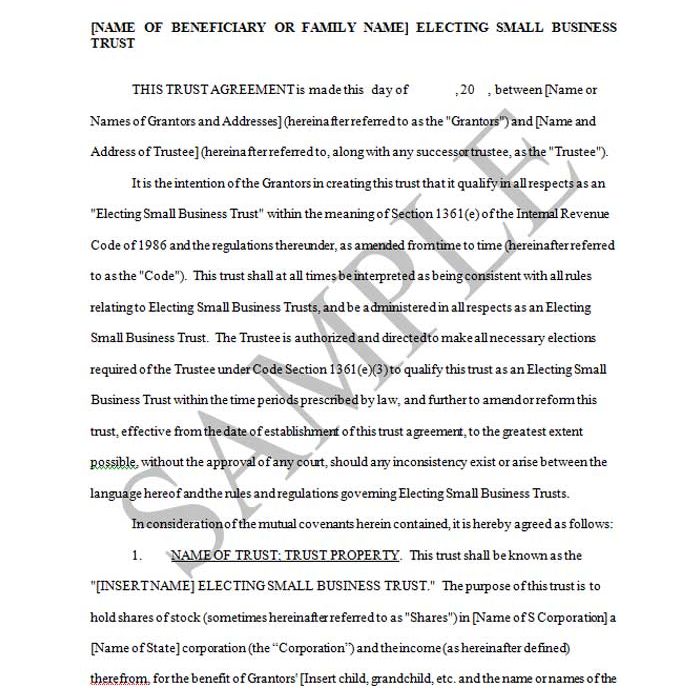

Electing Small Business Trust (13 Pages)

This Trust is an Electing Small Business Trust, i.e. a Trust created to follow the rules and requirements that allow this Trust to be treated as a valid Subchapter S corporation shareholder. The Electing Small Business Trust is often used in estate and/or income tax planning where S corporation owners wish to transfer some of the Subchapter S corporation shares, but do not wish their children to gain any control over the corporation (hence no outright transfer) or be obliged to receive annual distributions of income (as would be the requirement if a Qualified Subchapter S Trust were created). The “ESBT” allows more control of the stock and its income by the Trustee. The Trust may also hold property other than the shares of a Subchapter S corporation.

This is an irrevocable trust designed to be a qualified holder of S corporation stock. In order to be so qualified, the income beneficiary of the trust must be the sole trust beneficiary, entitled to all of the trust income currently. Article 3 of the Form is designed to satisfy this and all of the other statutory requirements of a Qualified Subchapter S Trust (“QSST”). Transfers of stock held in the trust to a beneficiary that would not qualify as a qualified S corporation shareholder are deemed invalid.

This Form is a Voting Trust Agreement. It includes: Voting Trust Agreement, Voting Trust Assignment, Voting Trust Certificate and Voting Trust Joinder Forms.

It allows shareholders to separate the voting rights from the economic and beneficial rights of owning shares of stock. A voting trust can be an eligible S Corporation shareholder if it meets certain requirements (See Section 1.2(f) below). The voting trust is a useful tool to assure continuity of management of a corporation, especially in the context of a family-owned and/or closely held business.

Author:Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization.

Electing Small Business Trust (13 Pages)Special Price $59.00 Regular Price $69.00

Electing Small Business Trust (13 Pages)Special Price $59.00 Regular Price $69.00