Medicaid Planning: Life Care Agreement (7 Pages)

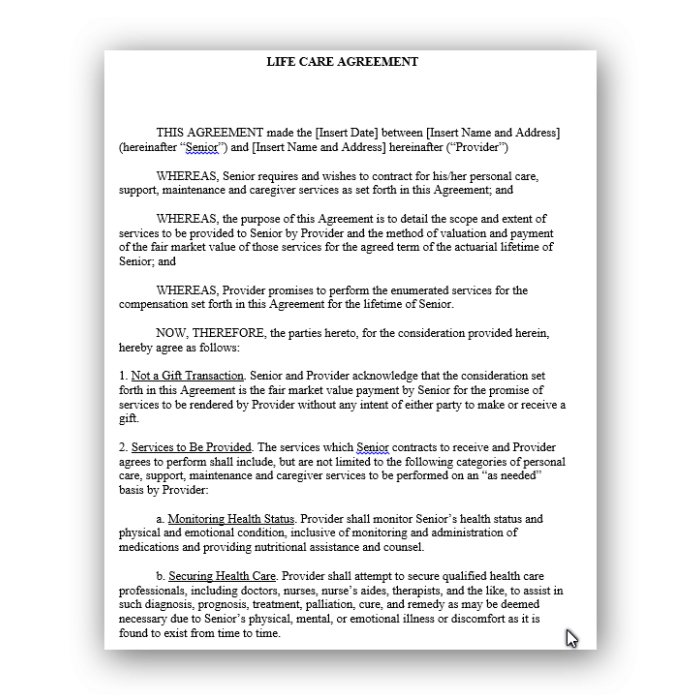

This is a Form of a Life Care Agreement. It is intended to present an appropriate method of having an elderly person (Senior) pay in advance for ongoing care services to be rendered by another (Provider) on behalf of Senior. Such arrangements, if properly structured based on the Senior’s life expectancy and a proper rate of payment, should permit Senior to pay funds in the nature of an appropriate life annuity and not have the payment of such funds negatively affect the eligibility of Senior for possible Medicaid assistance.

This is a Form of a Life Care Agreement. It is intended to present an appropriate method of having an elderly person (Senior) pay in advance for ongoing care services to be rendered by another (Provider) on behalf of Senior. Such arrangements, if properly structured based on the Senior’s life expectancy and a proper rate of payment, should permit Senior to pay funds in the nature of an appropriate life annuity and not have the payment of such funds negatively affect the eligibility of Senior for possible Medicaid assistance.

A Life Care Agreement is often entered into between a parent and a child. It is a means to compensate the child for services to be rendered to parent without raising issues of fairness and propriety among the other children of parent who may not be acting as caregivers.

SUGGESTED CLE COURSES: Please note: Mr. Siegel's "Social Security, Medicare And Medicaid: What You Need To Know" is currently available on audio CD and DVD atwww.nlfcle.com and online at www.nlfonline.com. On both of these web sites, click on your state (or any state if you do not care about earning CLE credits) and scroll down to the course title which appears under the heading "Other".

Author:

Steven G. Siegel is president of The Siegel Group, which provides consulting services to attorneys, accountants, business owners, family offices and financial planners. Based in Morristown, New Jersey, the Group provides services throughout the United States. Mr. Siegel is the author of many books, including: The Grantor Trust Answer Book (2012 and 2013 CCH); CPA’s Guide to Financial and Estate Planning (AICPA 2012); and Federal Fiduciary Income Taxation (Foxmoor 2012). In conjunction with numerous tax planning lectures he has delivered for the National Law Foundation, Mr. Siegel has prepared extensive lecture materials on the following subjects: Planning for An Aging Population; Business Entities: Start to Finish; Preparing the Audit-Proof Federal Estate Tax Return; Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts, Introduction to Estate Planning; Intermediate-Sized Estate Planning; Social Security, Medicare and Medicaid: Explanation and Planning Strategies; Subchapter S Corporations: Using Trusts as Shareholders; Divorce and Separation: Important Tax Planning Issues; The Portability Election; Generation-Skipping Transfer Tax: A Comprehensive Review; and many other titles. Mr. Siegel has delivered hundreds of lectures to thousands of attendees in live venues and via webinars throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including The Heckerling Institute on Tax Planning, CCH, National Law Foundation, AICPA, Western CPE, the National Society of Accountants, the National Tax Institute, Cohn-Reznick, Professional Education Systems, Inc., Foxmoor Education, many State Accounting Societies and Estate Planning Councils as well as on behalf of private companies. He is presently serving as an adjunct professor of law in the Graduate Tax Program (LLM) of the University of Alabama, and has served as an adjunct professor of law at Seton Hall and Rutgers University law schools. Mr. Siegel holds a bachelor’s degree from Georgetown University (magna cum laude, phi beta kappa), a juris doctor from Harvard Law School and an LLM in taxation from New York University Law School.