Disability Insurance Reimbursement Plan (6 Pages)

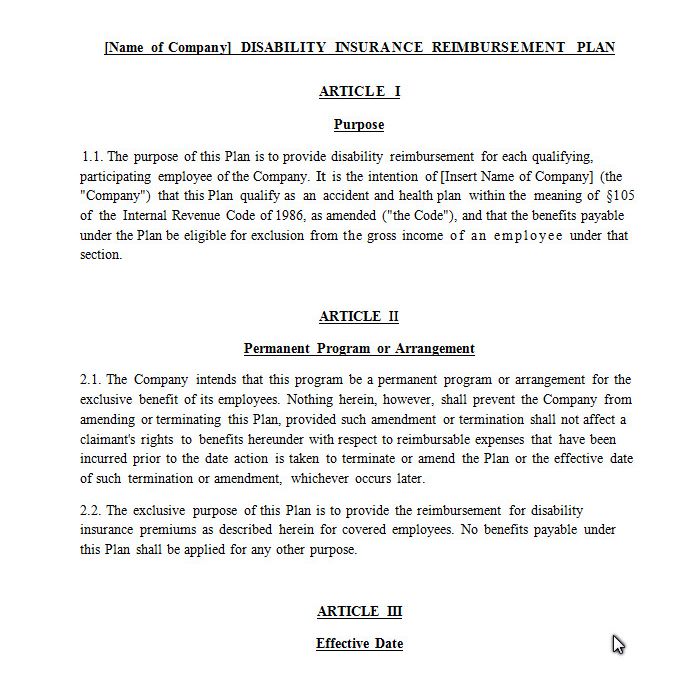

This Form is a Disability Insurance Reimbursement Plan to be provided by an employer to selected employees. It is designed to allow the employee to pay for his or her own disability insurance on an annual basis – and if the employee does become disabled, there is no Company insurance reimbursement, thus allowing the employee to be the payer of the insurance and allowed to treat any insurance proceeds as tax-free under Code Sections 105 and 106. If the employee was not disabled for a given year, then the employer makes a non-taxable reimbursement of the insurance premium paid by the employee in the following year.

This Form is a Disability Insurance Reimbursement Plan to be provided by an employer to selected employees. It is designed to allow the employee to pay for his or her own disability insurance on an annual basis – and if the employee does become disabled, there is no Company insurance reimbursement, thus allowing the employee to be the payer of the insurance and allowed to treat any insurance proceeds as tax-free under Code Sections 105 and 106. If the employee was not disabled for a given year, then the employer makes a non-taxable reimbursement of the insurance premium paid by the employee in the following year.

-

Phantom Stock Plan (8 Pages)$49.00

Phantom Stock Plan (8 Pages)$49.00